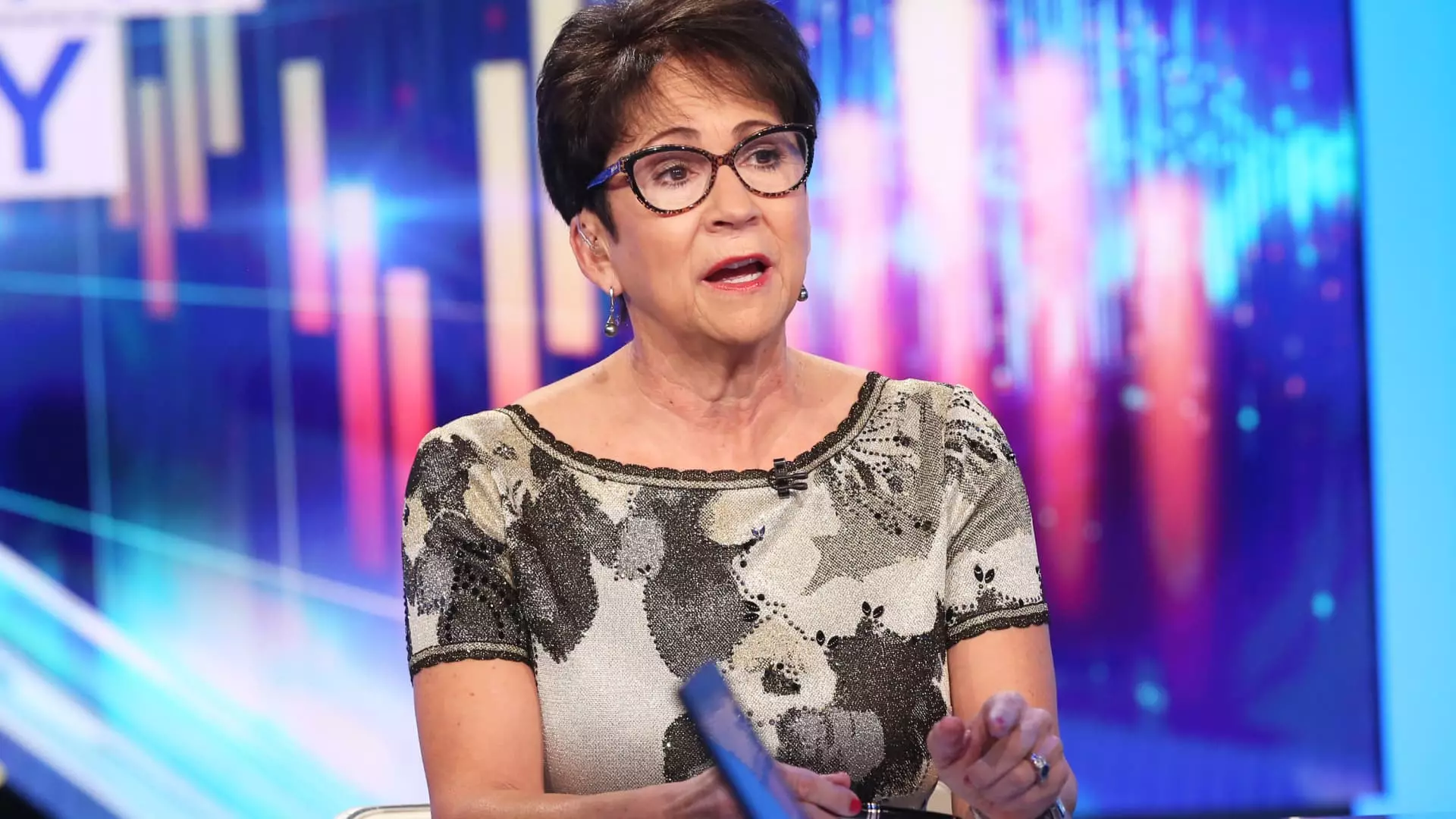

Artificial intelligence has been a game-changer for many technology companies, but the benefits of AI extend beyond the tech sector. According to Nancy Tengler, chief executive officer and chief investment officer of Laffer Tengler Investments, old economy companies that are embracing digital and generative AI are set to experience significant growth and improved profit margins. These companies have incorporated robotics and AI technologies into their operations, leading to increased productivity and efficiency.

Examples of Attractively Valued Stocks

Tengler identified several attractively valued stocks that she refers to as the “picks and shovels” of AI. Companies like Emerson Electric, L3Harris Technologies, Visa, Walmart, and McDonald’s are expected to see continued growth and stock performance due to their adoption of AI technologies. These companies have leveraged AI to streamline operations, enhance customer experiences, and drive innovation within their respective industries.

Industrial companies such as Emerson Electric and L3Harris Technologies have made significant strides in automating their processes through digitization. Tengler highlighted these companies as examples of firms that are leveraging AI to improve efficiency and drive growth. By incorporating AI into their operations, these companies have positioned themselves for long-term success in an increasingly digital world.

Shares of companies like Emerson Electric have seen impressive gains, outperforming market benchmarks and attracting positive analyst sentiment. The adoption of AI has played a key role in driving these companies’ stock performance and overall success. With the continued integration of AI technologies, these companies are poised to maintain their growth trajectory and deliver value to investors.

Companies like Walmart have embraced AI technologies to enhance their e-commerce operations and improve overall efficiency. By leveraging generative AI, Walmart has optimized its supply chain, increased automation in distribution centers, and achieved double-digit growth in global e-commerce sales. This strategic approach to AI adoption has enabled Walmart to drive continued growth and maintain a competitive edge in the retail industry.

Tengler’s investment strategy emphasizes companies that offer “growth at a reasonable price,” which includes mainstream AI plays like Broadcom, Amazon, and Microsoft. By diversifying investments across a range of AI-driven companies, Tengler aims to position her clients for long-term success in a rapidly evolving market. This approach allows investors to capitalize on the growth potential of AI technologies while mitigating risk through a diversified portfolio.

The impact of artificial intelligence on old economy companies is significant and continues to drive growth and innovation across various industries. By embracing AI technologies, companies can enhance productivity, improve operational efficiency, and unlock new opportunities for expansion. As AI becomes increasingly integrated into business operations, old economy companies that adapt and innovate will be well-positioned to thrive in a digital-first world.

Leave a Reply