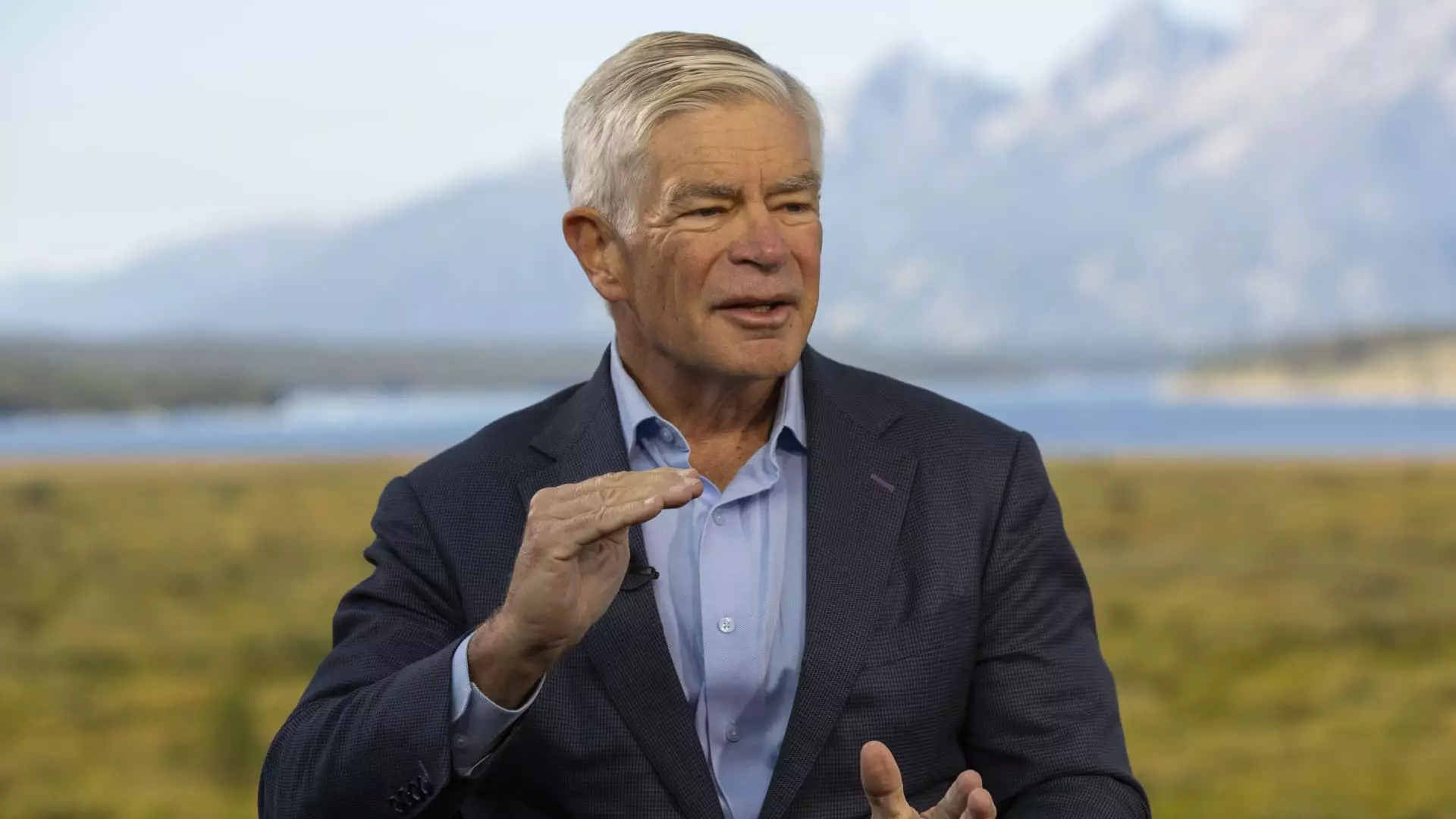

Philadelphia Federal Reserve President Patrick Harker recently provided a strong endorsement for an interest rate cut coming in September. In an interview with CNBC from the Federal Reserve’s annual retreat in Jackson Hole, Wyoming, Harker expressed a clear belief that a rate cut is almost certain when officials convene next month. This position is significant as it marks one of the most direct statements made by a central bank official regarding the imminent easing of monetary policy.

Market expectations are high, with a 100% certainty of a quarter percentage point cut and a 1-in-4 chance of a 50 basis point reduction. Despite this, Harker indicated that he is still undecided on the specific amount of the rate cut. He mentioned the need to analyze additional data in the upcoming weeks before making a decision. This uncertainty reflects the complex considerations that drive monetary policy decisions.

Harker emphasized the independence of the Federal Reserve from political concerns, particularly as the upcoming presidential election looms in the background. He highlighted the Fed’s role as proud technocrats whose primary responsibility is to analyze data and respond appropriately. This commitment to data-driven decision-making underscores the importance of economic indicators in shaping monetary policy.

Insights from Kansas City Fed President Jeffrey Schmid

Kansas City Federal Reserve President Jeffrey Schmid also weighed in on the future of monetary policy in a CNBC interview. While his stance was less direct than Harker’s, Schmid hinted at a possible rate cut in the near future. He pointed to the rising unemployment rate as a significant factor influencing policy decisions. The shift from a tight labor market to a more balanced environment has implications for inflation dynamics and overall economic stability.

Schmid noted the cooling of job indicators and the gradual increase in the unemployment rate as signs of a changing labor market landscape. While this shift has helped alleviate inflationary pressures, Schmid emphasized the need for continued vigilance and proactive policy responses. He expressed confidence in the resilience of banks under current high-rate conditions but acknowledged the importance of reassessing monetary policy settings in light of evolving economic conditions.

Future Voting and Policy Implications

Harker, who does not have a vote on the rate-setting Federal Open Market Committee this year, will have the opportunity to vote on policy decisions in 2026. Schmid, on the other hand, is set to have a vote next year, which highlights the rotation of voting privileges among Federal Reserve officials. The collaboration and diversity of perspectives within the Federal Reserve system contribute to robust policy debates and informed decision-making processes.

The insights provided by Philadelphia Federal Reserve President Patrick Harker and Kansas City Federal Reserve President Jeffrey Schmid offer valuable perspectives on the future direction of monetary policy. While uncertainties remain regarding the magnitude of potential rate cuts and the timing of policy adjustments, both officials underscore the importance of data analysis, independence from political influences, and proactive responses to evolving economic conditions. As the Federal Reserve navigates a complex economic landscape, the thoughtful consideration of multiple viewpoints and rigorous analytical frameworks will be essential in shaping effective monetary policy strategies.

Leave a Reply