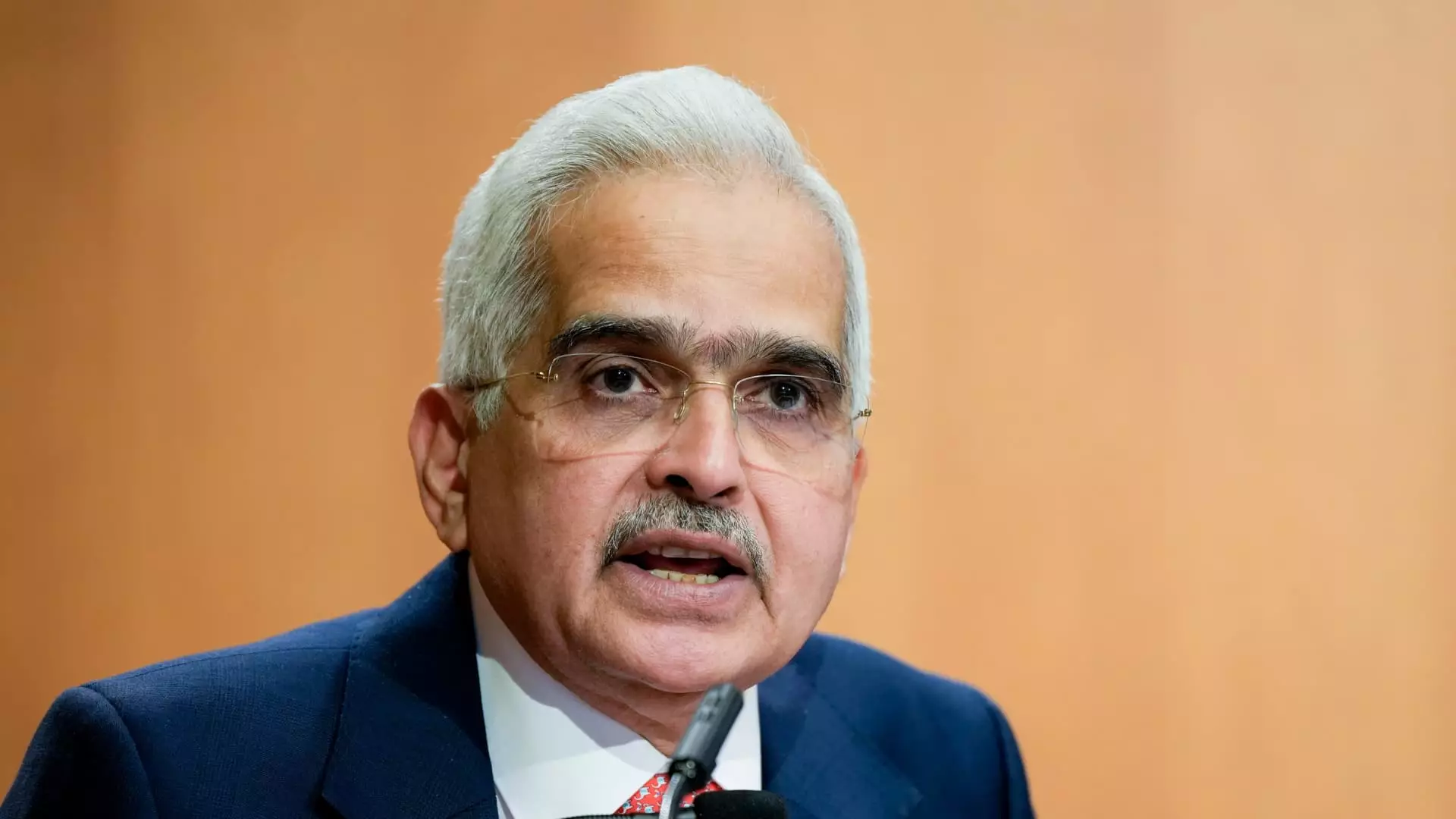

The world economic landscape has been marked by a series of unpredictable shocks that have posed significant challenges to central banks globally. At the forefront of navigating these complexities is Shaktikanta Das, the Governor of the Reserve Bank of India (RBI), who recently spoke at the CNBC-TV18 Global Leadership Summit in Mumbai. In his discourse, Das emphasized that despite achieving a “soft landing,” the looming specter of inflation and slowing economic growth warrants continuous vigilance. The implications of geopolitical conflicts, commodity price fluctuations, and climate-related issues remain potent forces that could derail the recovery narrative.

Central banks, in particular, face the daunting task of stabilizing economies amid heightened market volatility. The recent performance of global monetary policies, particularly within advanced economies, has been commendable, yet Das underscores the persistent risks that linger. As he articulated, “headwinds from geopolitical conflicts, geoeconomic fragmentation, commodity price volatility, and climate change continue to grow.” This acknowledgment sets the stage for a deeper exploration of how interconnected and fragile the global economic framework has become.

One of the striking observations made by Das is the apparent contradictions within the financial markets, such as the strengthening of the U.S. dollar even as the Federal Reserve pursues a path of interest rate cuts. As of Thursday morning, the U.S. dollar index recorded an increase, suggesting a robustness that stands at odds with the prevailing monetary easing by the Fed. This juxtaposition raises vital questions about the underlying factors driving currency strength and the resilience of investors amidst shifting financial policies.

The anticipation surrounding future U.S. interest rates, especially with the looming prospect of a Trump presidency, adds another layer of complexity to the economic outlook. Speculation around higher tariffs and stringent immigration policies under a second Trump term potentially aggravates inflation, thereby challenging the current trajectory of monetary easing. The interplay of these elements demands careful observation, as it may dictate the Federal Reserve’s response in the months ahead.

Das further highlighted the unusual dynamics present in the commodities market, particularly the divergence observed between gold and oil prices, which typically correlate. While investors have consistently demonstrated an affinity for gold during times of economic uncertainty, this current dissonance reveals deeper market sentiments influenced by non-traditional variables. The pricing trajectories of these commodities reflect investors’ risk appetite and perceptions of macroeconomic stability—parameters that are decidedly volatile against the backdrop of rising geopolitical tensions.

Moreover, the resilience of financial markets in the face of escalating geopolitical risks is noteworthy. As tensions increase, particularly given the ongoing conflicts globally, the financial markets have paradoxically exhibited durability, raising questions about market psychology and the efficacy of risk assessment models employed by investors. This evolution suggests that market participants are increasingly habituated to volatility, adapting their strategies and expectations accordingly.

Refocusing on India, Das communicated optimism regarding the country’s economic trajectory, forecasting steady growth alongside a potential moderation in inflation. His assertion that the Indian economy has weathered recent shocks while displaying resilience speaks volumes about its foundational strength and adaptability. However, the call from Indian Union Minister Piyush Goyal for the RBI to consider further easing of monetary policy to stimulate growth illustrates an ongoing debate within India’s economic governance.

Goyal’s appeal for rate cuts reflects a broader concern about sustaining momentum in what is positioned as one of the fastest-growing economies globally. Balancing growth aspirations with inflationary pressures remains a pivotal challenge. The RBI’s decision to maintain the key interest rate at 6.5% acknowledges these complexities while keeping the door open for adjustments depending on evolving economic indicators.

As central banks continue to navigate this multifaceted economic environment, the need for strategic foresight and flexibility is paramount. The dialogue around monetary policy must incorporate the unpredictable elements that characterize the current world order. For India and its Reserve Bank, the commitment to fostering growth while mitigating the risks of inflation will demand a delicate balancing act—one that will undoubtedly shape the country’s economic landscape in the years to come. The insights shared by Das at the Global Leadership Summit underscore the importance of global cooperation and adaptability in addressing the unprecedented challenges that lie ahead.

Leave a Reply