In 2016, the cryptocurrency exchange Bitfinex faced one of the most significant hacks in digital currency history, resulting in the theft of nearly 120,000 bitcoin. The mastermind behind this colossal breach, Ilya Lichtenstein, would later find himself in the crosshairs of law enforcement for his shocking and elaborate money-laundering scheme. What was initially valued at $70 million has seen astronomical growth, now amounting to a staggering $10.5 billion due to the crypto market’s volatile nature. This heist has not only transformed the landscape of cryptocurrency crime but has also raised serious questions regarding accountability and cybersecurity within the industry.

Legal Proceedings and Sentencing

Lichtenstein’s legal troubles culminated in a recent court ruling in Washington D.C., where he received a five-year prison sentence for his role in the money laundering conspiracy that sought to disguise the origin of the stolen bitcoin. This sentence, paired with three years of supervised release, reflects the seriousness of his offenses and the judicial system’s commitment to addressing cybercrime. During his sentencing, Lichtenstein expressed a desire to take full responsibility, a notable confession given the magnitude of his actions, and indicated his willingness to make amends. His emotional appeal did little to mitigate the extensive consequences of his criminal endeavors.

The public acknowledgment of his guilt at the plea hearing in August 2023 marked a significant moment in the case, shifting the narrative from denial to accountability. Prosecutors made it clear that Lichtenstein’s actions were not just petulance in the digital realm; they illustrated a calculated effort to manipulate and subvert the burgeoning world of cryptocurrencies.

What makes Lichtenstein’s case particularly compelling is the sophistication of the laundering techniques employed. Prosecutors described the methods as “the most complicated money laundering techniques they had seen to date,” underscoring the extent to which he went to obscure the trail of his illicitly acquired wealth. Over five years, Lichtenstein engaged in a meticulous process of funneling money through a variety of channels to sanitize the proceeds of his cyber theft. This complexity not only showcases Lichtenstein’s technical acumen but also raises concerns about regulatory preparedness in an industry still grappling with its identity and ethical frameworks.

Moreover, this case exemplifies the somewhat chaotic environment of cryptocurrency regulation, where the line between legal practices and criminal behavior can often appear blurred, allowing for significant financial exploitation. The evolution of digital currencies has outpaced regulatory responses, leaving gaps that can be exploited by tech-savvy criminals like Lichtenstein.

Following his arrest in February 2022, law enforcement agencies announced the seizure of more than 94,000 bitcoin, worth approximately $3.6 billion at the time. This figure has risen in value since the incident, illustrating the market’s volatility and continual evolution, further complicating the restitution efforts for victims like Bitfinex. Prosecutors indicated that they aimed to rectify the injustice by returning these assets to either Bitfinex or potential rightful owners.

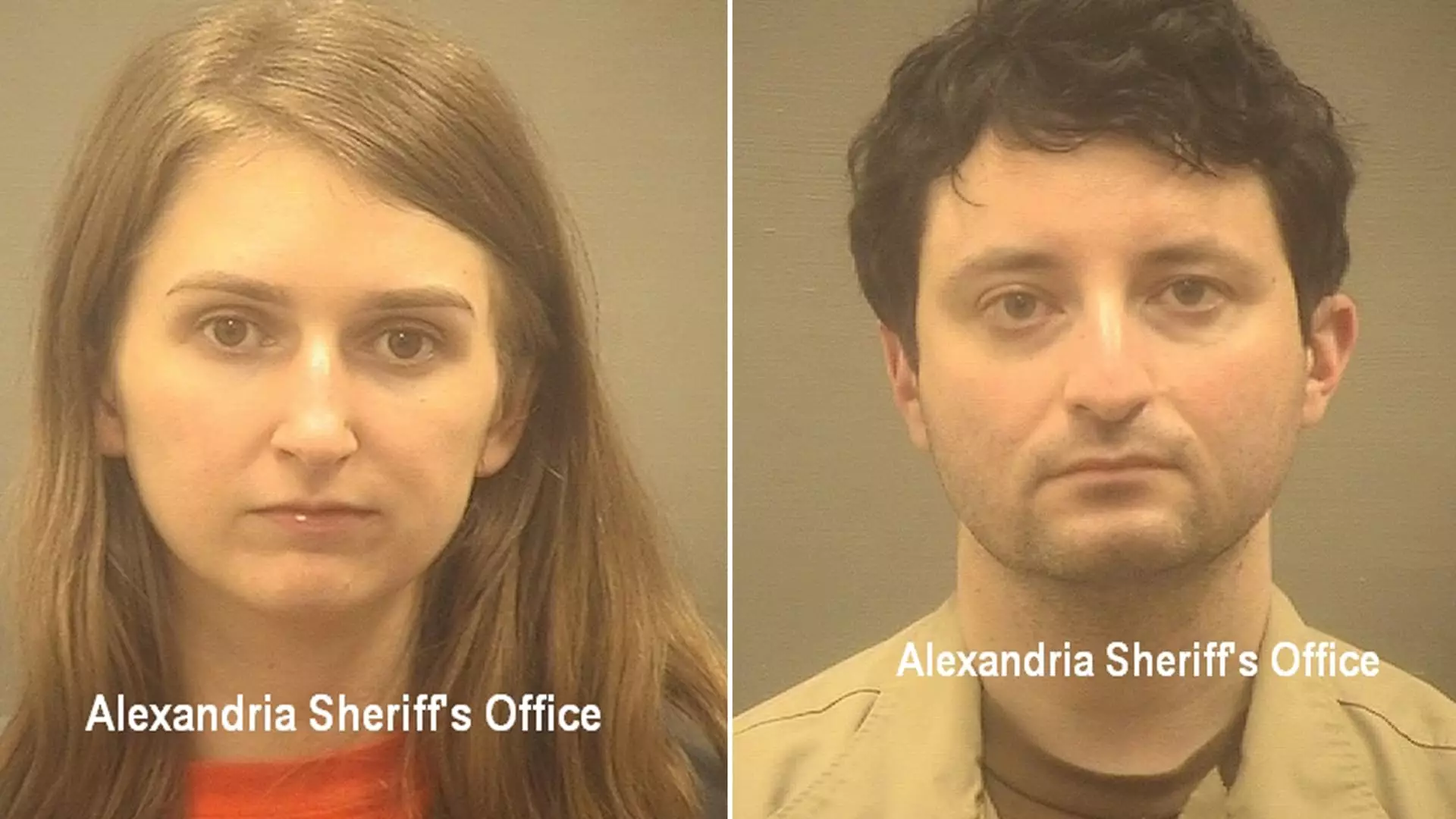

Ilya Lichtenstein’s sentence serves as a cautionary tale, not just for aspiring hackers but for anyone engaging in the murky waters of cryptocurrency trading and investments. His wife, Heather Rhiannon Morgan, who participated at a much lower level in the money laundering operation, is set to be sentenced separately, and her fate will undoubtedly hinge on her perceived complicity and cooperation during the investigation.

As the cryptocurrency landscape continues to evolve, the implications of this and similar cases will weigh heavily on industry stakeholders, regulators, and users. Lichtenstein’s punishment is a reminder that even in a decentralized space, actions have consequences, and the burgeoning world of cryptocurrencies will require vigilant legal frameworks to combat ongoing threats and uphold integrity.

Leave a Reply