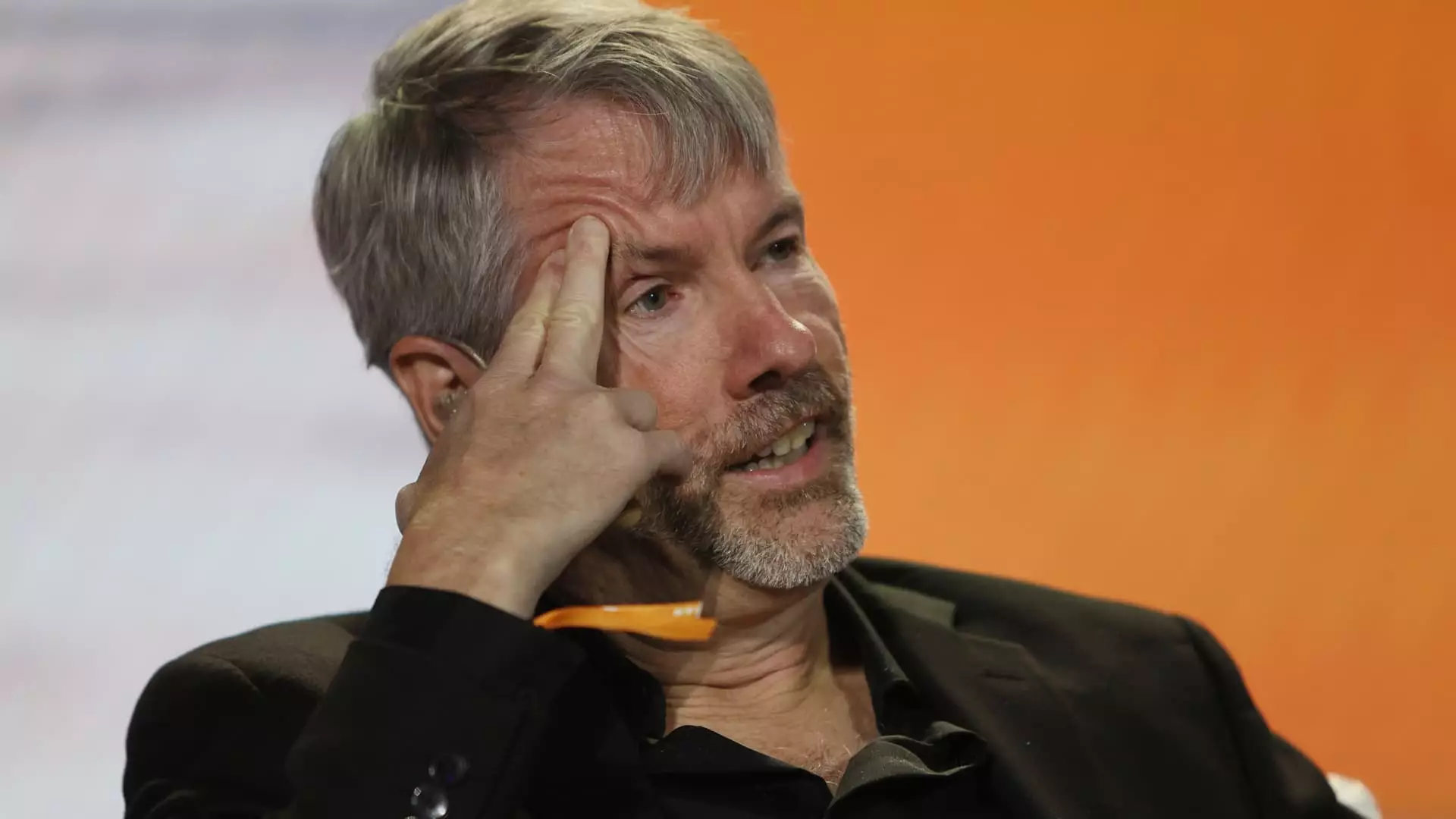

In recent years, the landscape of corporate investment has been transformed by the rise of cryptocurrencies, particularly Bitcoin. Specific individuals have emerged as advocates for integrating digital assets into traditional financial structures, with Michael Saylor standing out as a notable proponent. As the billionaire executive chairman of MicroStrategy, Saylor has led his company into an aggressive Bitcoin acquisition strategy, which has significantly increased its stock price and overall market valuation. However, his recent proposal for Microsoft to follow suit faced substantial pushback from shareholders, raising critical questions about the future of cryptocurrency in corporate finance.

The Proposal and Its Reception

During Microsoft’s annual shareholder meeting, Saylor put forth a proposition urging the tech giant to allocate a portion of its extensive cash reserves—currently estimated at $78.4 billion—into Bitcoin. His reasoning lies in the belief that digital currencies represent the next technological revolution, essential for companies aiming to secure their financial futures in a rapidly evolving market. In a video presentation that garnered significant attention, Saylor touted Bitcoin’s impressive average annual returns of 62% from August 2020 to November 2024, positioning it as a superior investment compared to Microsoft’s own performance and that of the broader S&P 500.

Despite the compelling statistics presented, Microsoft’s shareholders ultimately rejected Saylor’s call for a more aggressive stance on Bitcoin investment. The decision was influenced by recommendations from proxy advisors who advocated voting against the proposal, underscoring the conservative approach many investors maintain toward cryptocurrencies.

Interestingly, Microsoft’s historical relationship with cryptocurrency indicates a cautious yet open-minded stance. The company began accepting cryptocurrency payments as early as 2014, suggesting an awareness of the evolving financial landscape. However, Microsoft has taken a measured approach to further investments in this asset class. Their treasury team has evaluated Bitcoin and other cryptocurrencies, but the absence of a substantial shift in their investment strategy reflects a broader hesitance within traditional corporations to embrace such volatile assets fully.

Amy Hood, Microsoft’s Chief Financial Officer, addressed this apprehension during the shareholder meeting, emphasizing that while the company continuously monitors cryptocurrency developments, they are also vigilant regarding the inherent risks associated with these assets. Unlike MicroStrategy, which has become synonymous with Bitcoin, Microsoft appears to be prioritizing stability and sustainability over aggressive speculation.

The contrast between Saylor’s aggressive Bitcoin accumulation strategy and Microsoft’s more conservative outlook reveals a broader dichotomy in corporate finance strategies. MicroStrategy’s approach has yielded remarkable direct financial gains, evidenced by a staggering stock price increase of nearly 500% this year. The company’s commitment has created a direct correlation between Bitcoin’s success and its stock performance, attracting investors enthusiastic about cryptocurrency’s potential.

Conversely, Microsoft’s deliberative strategy reflects a cautionary tale for other corporations. While MicroStrategy’s model demonstrates the potential for massive gains through Bitcoin investment, it also emphasizes the risks of tying corporate identity and financial stability to such volatile assets. The fallout from a significant downturn in Bitcoin’s value could have crippling effects on firms like MicroStrategy, which have fully embraced the cryptocurrency at the expense of more diverse investment portfolios.

As the cryptocurrency landscape continues to evolve, the future of Bitcoin in corporate finance remains a point of contention. Saylor’s push for Microsoft to adopt a more Bitcoin-oriented strategy mirrors a growing movement among proponents of digital currencies who believe traditional corporations must diversify into cryptocurrencies to remain competitive. However, the resistance from Microsoft’s shareholders underscores the ongoing caution surrounding such investments.

Ultimately, the decision by large corporations like Microsoft to either embrace or reject Bitcoin and other cryptocurrencies will shape the trajectory of both corporate finance and the wider acceptance of digital assets. Stakeholders must weigh the potential for high returns against the risks of volatility as they navigate this complex environment. As Saylor continues to advocate for Bitcoin’s place in corporate treasury strategies, the conversation surrounding cryptocurrency’s legitimacy may only be beginning—signaling a pivotal moment for financial institutions and tech giants alike.

Leave a Reply