In a world fraught with market instability and economic uncertainty, the whispers from financial institutions like Bank of America offer a glimmer of hope for investors. As the firm identifies a select group of stocks it believes are set to thrive, a distinctive theme emerges: these companies not only display resilience but are also adapting to the rapidly shifting economic landscape. The power players in this narrative include giants like Nvidia, Amazon, Netflix, and Boot Barn. Each is positioned uniquely to capitalize on both current trends and future growth potential, but what resonates most is their collective ability to weather storms while maintaining a trajectory that investors can lean on.

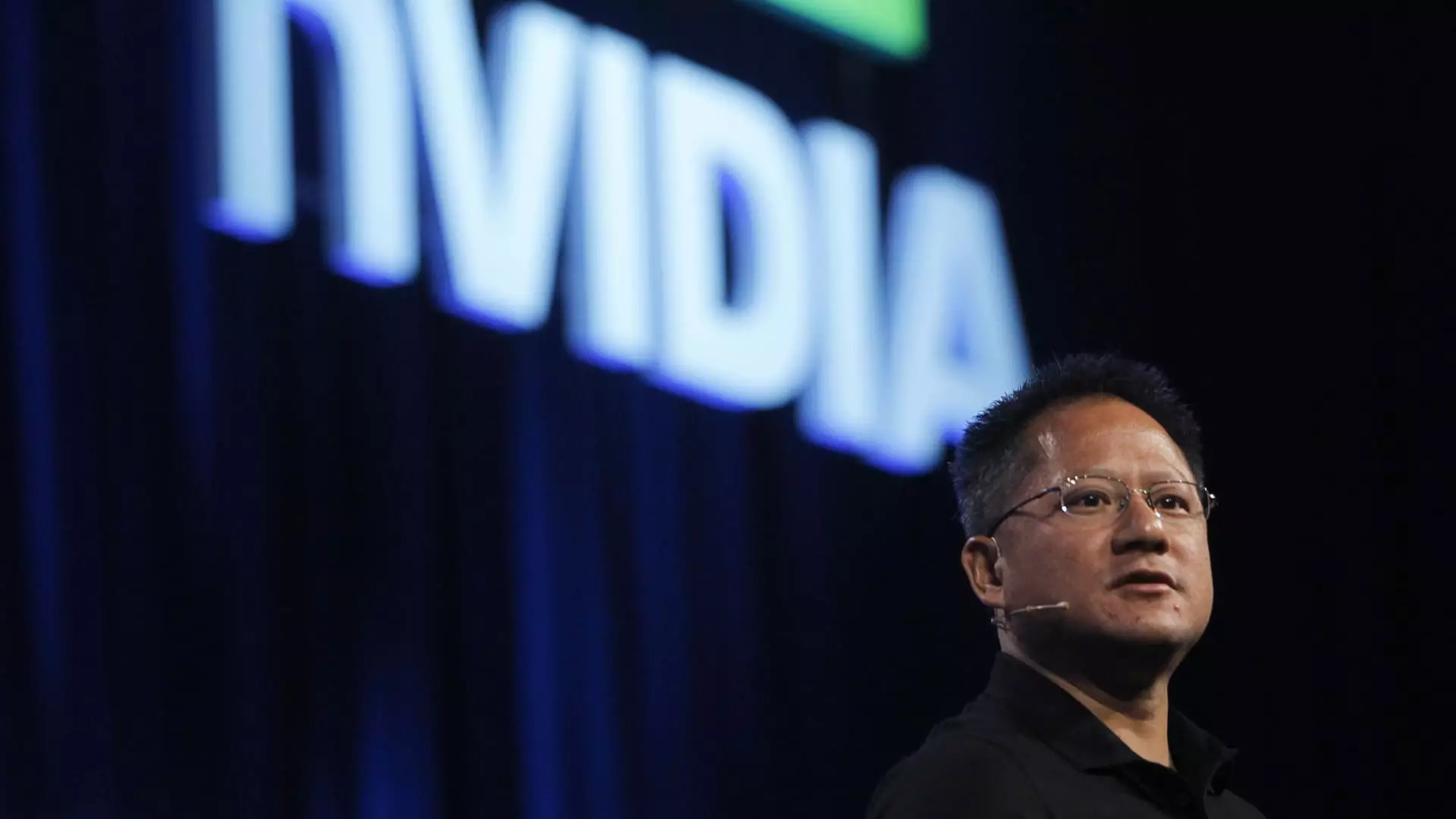

Nvidia: The Apex of AI Innovation

At the forefront of this narrative is Nvidia, a titan whose stock keeps trending upwards as demand for artificial intelligence surges. Bank of America has firmly entrenched Nvidia as a top buy, projecting its price target to soar. The company’s stronghold lies in its pioneering performance in AI processing, lighting the path for a wave of innovation that is likely to reshape industries. As the convergence of AI and everyday business practices continues, Nvidia’s established presence and cutting-edge technology give it a significant advantage over smaller competitors. In an era where technological prowess dictates market leaders, Nvidia appears ready to scale new heights, making a compelling case for investment.

Amazon: The Robotics Revolution

Next, we turn our gaze on Amazon, heralded as a major player not just in e-commerce but increasingly in the realm of advanced technology. With Bank of America raising its price target for Amazon, it’s clear that analysts are banking on the future success driven by robotics and artificial intelligence. By integrating robotics into its operational landscape, Amazon is not merely easing labor costs but is also enhancing accuracy and efficiency, unlocking cost-saving measures that traditional businesses might only dream of. As we stand on the precipice of a new era of logistics and delivery, Amazon’s formidable grip on e-commerce, coupled with its innovations, positions it as a kingpin ready to seize booming market opportunities.

Netflix: The Unsung Hero of Entertainment

Turning the page to entertainment, Netflix emerges as a surprising contender in the stock market narrative. The streaming service, which once faced criticism for its heavy spending, is now painting a picture of stability and measured growth. Analyst Jessica Reif Ehrlich has fortified the bullish sentiment surrounding Netflix, boosting price targets based on the platform’s burgeoning advertising prospects and solid subscriber trends. Despite a tempest of competing services, Netflix’s monumental scale in streaming and diversified content strategy reveal its innate ability to hold ground and expand in this crowded marketplace. For investors, Netflix no longer feels like a gamble but a calculated move toward securing returns in the golden age of streaming.

Boot Barn: A Cultivated Niche with Potential

Less conventional yet equally striking is Boot Barn, an embodiment of niche success in the fashion retail landscape. With a keen focus on Western-inspired styles, this company has managed to cultivate a loyal customer base while enjoying consistent growth. Analysts cite strong performance across various categories, indicating that Boot Barn’s recent ascension is not a fluke but a testament to its strategic method of integrating regional culture into retail. In environments where larger retailers often falter, Boot Barn stands as a hopeful example of how specialized focus can yield dividends—and that diversification doesn’t always mean spreading too thin.

The Underlying Strengths and the Path Forward

The conviction from Bank of America regarding these stocks reveals deeper insights into consumer behaviors and technological trends shaping tomorrow’s economy. In an era marked by rapid change and geopolitical strains, companies with robust strategies and resilient business models emerge as the true captains of industry. For investors, maintaining a pulse on sectors that embrace innovation and adaptation could spell significant financial success.

What resonates profound in this stock analysis is the understanding that growth opportunities exist not merely in the mainstream realms but also in specialized niches. Companies like Boot Barn prove that even in dire economic conditions, focused strategies can carve out spaces for profitability. The emphasis on technology, efficiency, and market adaptability sets a clear tone for discerning investors aiming to shield themselves from pervasive market volatility.

As we look toward future investments, the compelling narratives surrounding Nvidia, Amazon, Netflix, and Boot Barn require attention. They represent not only economic stability but also the potential for substantial financial return in a world that can often seem poised for chaos. The confluence of resilience and innovation is clearly a compelling proposition for those willing to invest in the right places.

Leave a Reply