In an economic landscape increasingly characterized by volatility and uncertainty, Warren Buffett’s Berkshire Hathaway stands as a steadfast fortress. While many investors frantically fled the market during a tumultuous week marked by President Donald Trump’s provocative tariffs, Berkshire showed remarkable resilience. Indeed, the company’s Class B shares experienced a decline of only 6.2%—much less severe than the S&P 500’s staggering 9.1% drop and the 10% nosedive faced by the tech-heavy Nasdaq Composite. Observing these figures, one cannot help but appreciate the prudent decision-making epitomized by Buffett, who has artfully navigated the treacherous waters of corporate America for decades.

This year, in the face of widespread market disarray, Berkshire Hathaway has demonstrated an impressive 8% gain. Such performance is indicative of its unique position; it is not merely another stock but a diversified conglomerate with investments across various sectors, including insurance, manufacturing, and energy. The essence of Berkshire’s success lies in its diversified portfolio and robust balance sheet—boasting an astounding $334 billion in cash reserves at the end of 2024. This financial fortitude not only sets it apart from peers but renders it immune to the erratic whims of political machinations.

A Technical Perspective: Momentum Indicators and Market Safety

From a technical analysis standpoint, Berkshire Hathaway emerges as a shining example of stability. Unlike many of the largest companies in the S&P 500, it is currently trading above its 200-day moving average—a crucial indicator of market momentum, as noted by Evercore ISI’s head of technical analysis, Rich Ross. This unique positioning is more than just a statistical anomaly; it reflects investor sentiment that seeks safety in the form of established, financially sound companies. The idea is that in times of strife, investors tend to gravitate toward stocks that offer a semblance of reliability and exceed the volatile trends of the broader market.

As Josh Brown, CEO of Ritholtz Wealth Management aptly pointed out, Berkshire represents an investment that is not solely tethered to the unpredictability of Trump’s policies. Instead, its performance hinges on elements intrinsic to the U.S. economy itself. Investments in Berkshire are viewed as a form of financial sanctuary amidst chaos. Such a perspective is critical, especially when one considers how many other stocks are hanging in the balance, their fortunes swayed by governmental decisions or global economic policies.

The Impact of Political Policy on Investment Strategies

The market’s reaction to Trump’s trade policies demonstrates a broader truth: the intersections of business and politics are fraught with unpredictability. The Democrats and Republicans each wield immense influence over economic policy, and this reality underscores the delicate balance that investors must maintain. As seen in the wake of recent tariff announcements, entire sectors can witness exponential backlash, illustrating how closely knit are policy and market performance.

For those invested in sectors vulnerable to political decision-making, the volatility can be a harsh wake-up call. The two-day, 1,500-point drop in the Dow Jones Industrial Average serves as a sobering reminder of how fragile the stock market can be. Consequently, savvy investors are beginning to dissect their portfolios, carving out positions not just based on potential returns but also on the stability of the companies in which they invest. Within this context, companies like Berkshire Hathaway, which exude inherent stability despite external pressures, become increasingly attractive.

The Unfounded Claims and Freedom of Speech

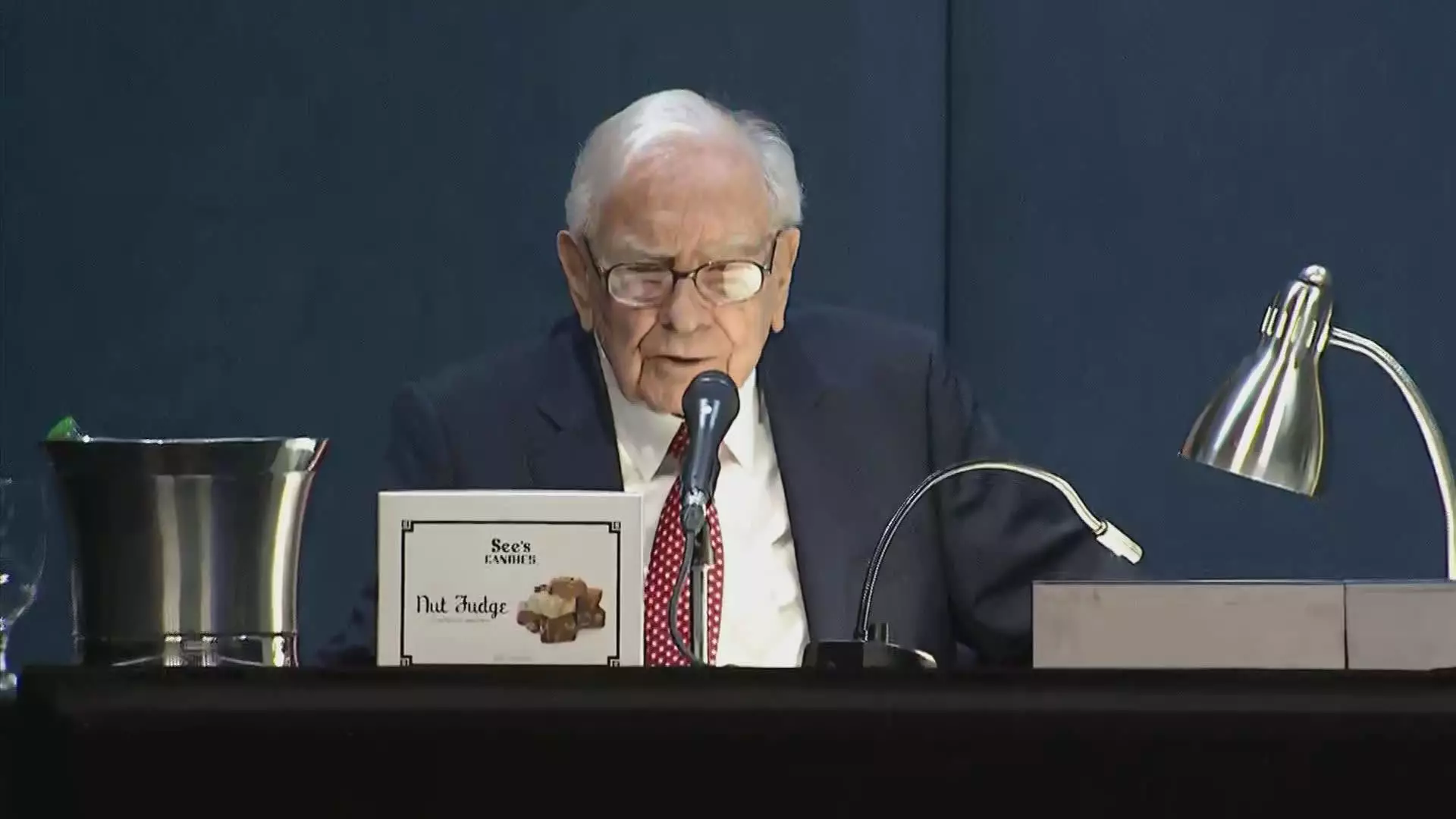

Recently, Buffett faced bizarre allegations circulating on social media that he had purportedly endorsed Trump’s derogatory characterizations of the stock market. In defending himself against these claims, Buffett reaffirms the importance of separating oneself from incendiary political rhetoric. Misinformation can overshadow substantial, logical assessments of market conditions and serve to create unnecessary panic among investors. The conversations about the stock market and the political landscape intersect but should remain independent in terms of credible financial advice.

In today’s climate, it is vital to discern the difference between sound business principles and the noise of political commentary. In the quest for economic security, skilled investors must continue to adapt and seek out stability—an endeavor that leads many to the bastion of safety that is Berkshire Hathaway.

Leave a Reply