As the trading day unfolds, investors are confronted with a variety of factors impacting market sentiments. Analyzing recent market movements and significant corporate happenings can be essential for making informed decisions. Here, we delve into the current landscape, summarizing five pivotal elements that investors should consider before jumping onto the trading floor.

On the heels of a strong weekly performance, the S&P 500 has advanced for its fourth consecutive day, marking a 0.75% increase. This positive trajectory reflects the buoyant investor sentiment, particularly towards technology stocks, as evidenced by the Nasdaq Composite, which outperformed its peers with a notable rise of 1%. The Dow Jones Industrial Average also joined the rally, increasing by 235.06 points or 0.58%. These movements were underscored during a crucial day, as investors closely observed the Producer Price Index (PPI) report, which presented the last inflation indicator prior to the upcoming Federal Reserve meeting. The PPI indicated a 0.2% rise in wholesale prices for August, aligning with market expectations and suggesting stability in the inflation outlook.

While the stock market showed resilience, labor market dynamics presented a contrasting narrative. Over 30,000 Boeing workers initiated a strike, following the rejection of a tentative contract agreement with the International Association of Machinists and Aerospace Workers. This significant labor action poses risks to Boeing, particularly as it affects the production lines of their most sought-after aircraft. The strike, labeled an “unfair labor practice strike” by IAM District 751 President Jon Holden, raises concerns regarding operational continuity, especially as Boeing continues to navigate through various challenges. The company has openly expressed its commitment to reassessing relations with its unionized workforce, emphasizing an eagerness to return to negotiations.

In the realm of corporate performance, Adobe’s third-quarter earnings sparked both enthusiasm and disappointment among investors. The company’s reported figures exceeded Wall Street’s expectations in terms of sales and earnings. However, a cautious forecast for the fourth quarter—anticipating lower earnings per share and revenue than analysts had hoped—resulted in an approximately 8% downturn in premarket trading. The juxtaposition of an 11% year-over-year increase in subscription revenue against a lackluster outlook suggests a complex situation where past success may not guarantee future growth, underlining the need for investors to critically assess future strategies.

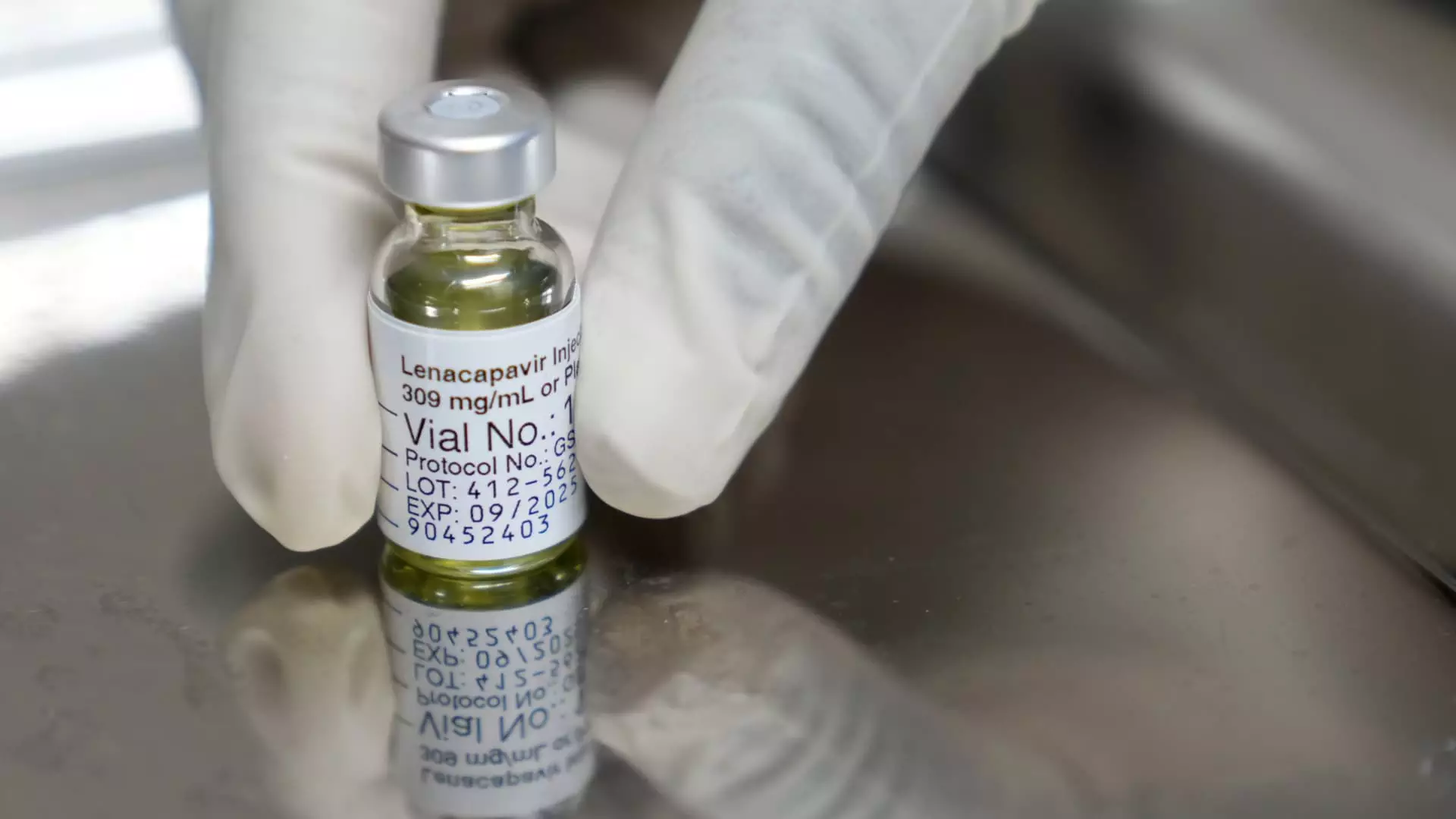

In the healthcare sector, Gilead Sciences made headlines with compelling results from a crucial clinical trial concerning their HIV treatment, lenacapavir. The trial demonstrated a remarkable 96% reduction in HIV infections, with only two out of 2,180 participants contracting the virus. The promising data strengthens the case for the U.S. Food and Drug Administration’s potential approval of the shot as a preventive measure against HIV. This marks a significant advance in public health possibilities, ensuring that pharmaceutical innovations remain a focal point for investors in the biotech field.

Finally, in the fashion and retail industry, Tapestry and Capri Holdings are embroiled in a courtroom battle over their proposed $8.5 billion merger. The Federal Trade Commission (FTC) has contested the merger, citing concerns over reduced competition and potential negative impacts on pricing and employee benefits within the handbag market. As the companies present their case on why the deal makes strategic sense, the outcome could significantly alter the competitive landscape of the luxury retail sector. The ongoing dialogue surrounding this merger encapsulates the broader conversation regarding competition and market consolidation, raising questions for retailers and consumers alike.

The trading day ahead is shaped by a myriad of factors including steady market gains, significant labor disputes, corporate earnings, breakthroughs in healthcare, and high-stakes merger discussions. Investors should remain vigilant, adapting their strategies in response to these dynamic and interlinked elements. The current market environment necessitates a well-rounded understanding not just of numbers, but of the broader implications behind them.

Leave a Reply