On Thursday, the Asia-Pacific stock markets experienced a notable rebound, indicating a strong recovery trend that could reshape investor sentiment. This resurgence is particularly attributed to robust economic stimulus measures introduced by the Chinese government earlier in the week. These initiatives have seemingly revitalized the confidence of investors, contributing to the upward trajectory of key indices across various markets in the region.

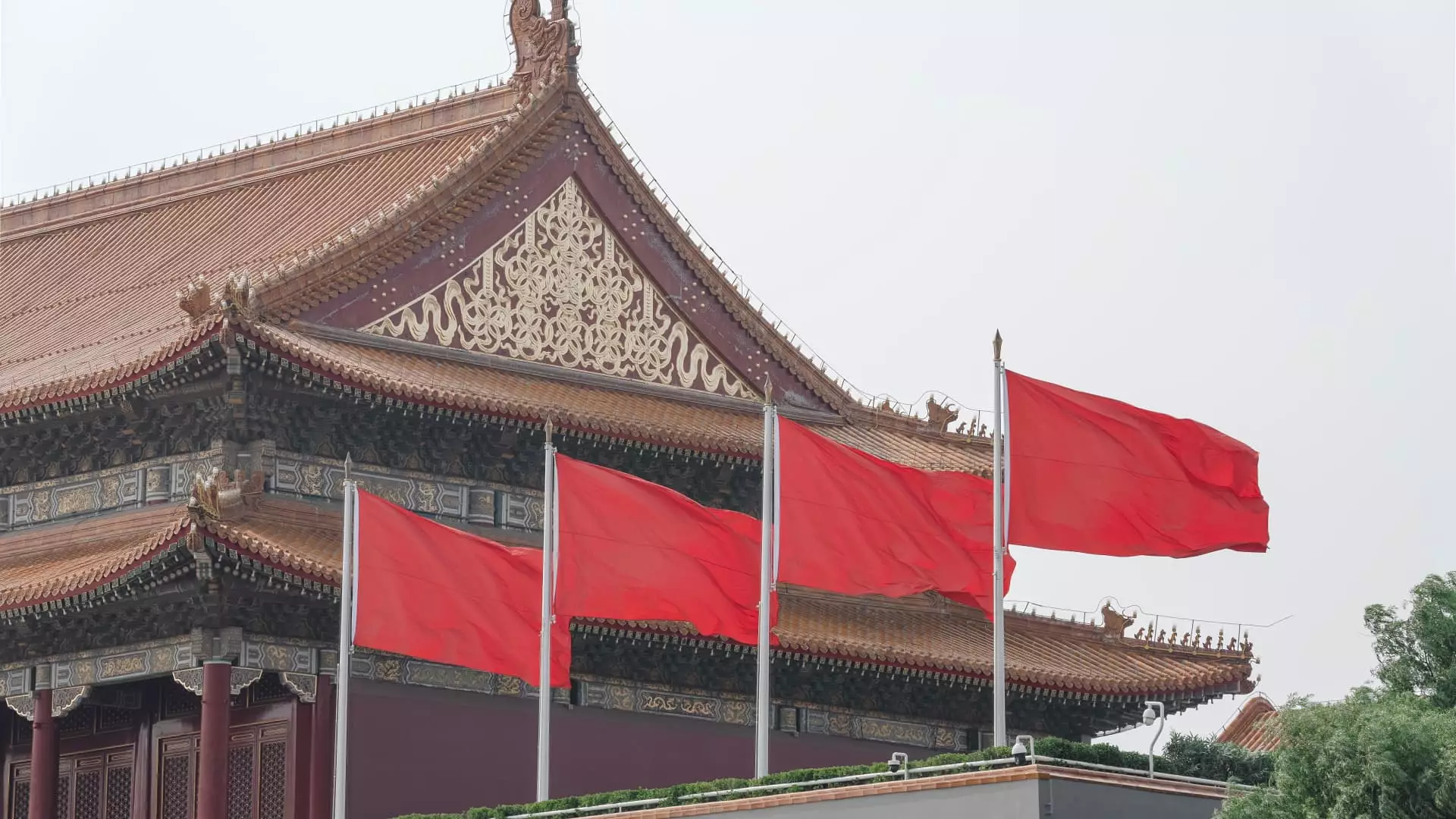

The Asian market’s recovery is predominantly fueled by the performance of China’s stock exchanges. The CSI 300, which tracks major companies listed on the Shanghai and Shenzhen stock exchanges, has entered a five-day winning streak, reaching heights not seen in nearly two months. By introducing targeted economic measures, Beijing appears to be laying the groundwork for stronger growth amid ongoing challenges. The momentum in the stock market underscores the positive reception of these policy changes, promoting optimism among investors.

In tandem with the mainland gains, Hong Kong’s Hang Seng Index (HSI) has also shown significant improvement, marking its third consecutive day of gains. Futures data indicates that HSI futures are trading at 19,336, a figure that comfortably surpasses its last closing value of 19,129.1. This growth has brought the index to its highest point since May, closely following the mainland’s upswing.

Japan’s markets have not lagged in this wave of positivity. The Nikkei 225 recorded a 1.7% increase at the onset of trading, while the broader Topix index was up by 1.2%. The positive influence of the Bank of Japan’s recent meeting minutes, which provided insights into future monetary policy direction, bolstered confidence and supported the market rally.

South Korea’s Kospi index has emerged as a standout performer in the region, jumping 1.77% and leading the pack with significant gains. The small-cap Kosdaq also enjoyed a healthy rise of 1.51%. Meanwhile, Australia’s S&P/ASX 200 experienced a more moderate increase of 0.68%, reflecting a general trend of stability and positive sentiment.

However, despite the flourishing conditions in the Asia-Pacific region, the sentiment in the U.S. appears to diverge sharply. Overnight trading in the United States witnessed both the Dow Jones Industrial Average and the S&P 500 pulling back from record levels. The S&P 500 declined by 0.19%, and the Dow fell by 0.7%, prompting questions about the sustainability of its record-breaking journey. In contrast, the Nasdaq Composite managed a marginal gain of 0.04%, indicating a mixed landscape in U.S. equities.

The stark contrast between the Asia-Pacific stock markets and their U.S. counterparts highlights varying regional responses to economic data and investor sentiments. While Asia tides are rising, fueled by proactive fiscal strategies, the U.S. markets are navigating through corrective phases. Investors and analysts alike will be closely monitoring these developments to gauge the potential for future investments across these diverse economic landscapes.

Leave a Reply