Nvidia, once a proud member of the exclusive $3 trillion market cap club, has recently faced a significant downturn, leaving Apple as the solitary titan in this elite group. This shift became particularly evident following Nvidia’s quarterly earnings report, which led to an 8% drop in share value. The resultant loss of approximately $273 billion in market capitalization highlights the volatility of the tech sector and instills apprehensions among investors regarding Nvidia’s sustained dominance in the marketplace.

On the day of Nvidia’s disappointing earnings announcement, both the S&P 500 and Nasdaq indices reacted negatively, declining by 1.6% and 2.8%, respectively. This performance illustrates that Nvidia’s financial health is closely intertwined with broader market trends. Despite its recent struggles, Nvidia still retains a prestigious position as the second most valuable technology enterprise in the United States, trailing behind only Apple and surpassing Microsoft, one of its key clientele. However, the company’s lackluster showing in the stock market in 2025, with a drop of 10% to date, signals deeper concerns among investors regarding future growth prospects.

Several factors contribute to Nvidia’s current challenges. Export controls, rising tariffs, and the emergence of more efficient AI models raise valid concerns about future profitability. Investors are beginning to question whether Nvidia’s substantial market valuation can be sustained amidst an environment of slow growth. Interestingly, despite these recent setbacks, Nvidia’s current market worth is still a staggering five times higher than it was at the inception of the generative AI boom just two years ago. Such figures underscore the rapid scale of Nvidia’s rise to prominence, first achieving a $3 trillion valuation in June 2024.

In the interim, Nvidia’s earnings report did reveal impressive metrics that, under different circumstances, would have assured stakeholders of its resilience. The company reported an astounding 78% year-over-year increase in revenue, amounting to $39.33 billion. Notably, its data center revenue saw extraordinary growth as well, surging 93% to reach nearly $36 billion. Such figures not only indicate the company’s adaptability but also its alignment with the ever-evolving tech landscape. Nvidia’s leadership has emphasized that these trends are not merely temporary; they expect robust demand for their products due to advancements in AI technologies.

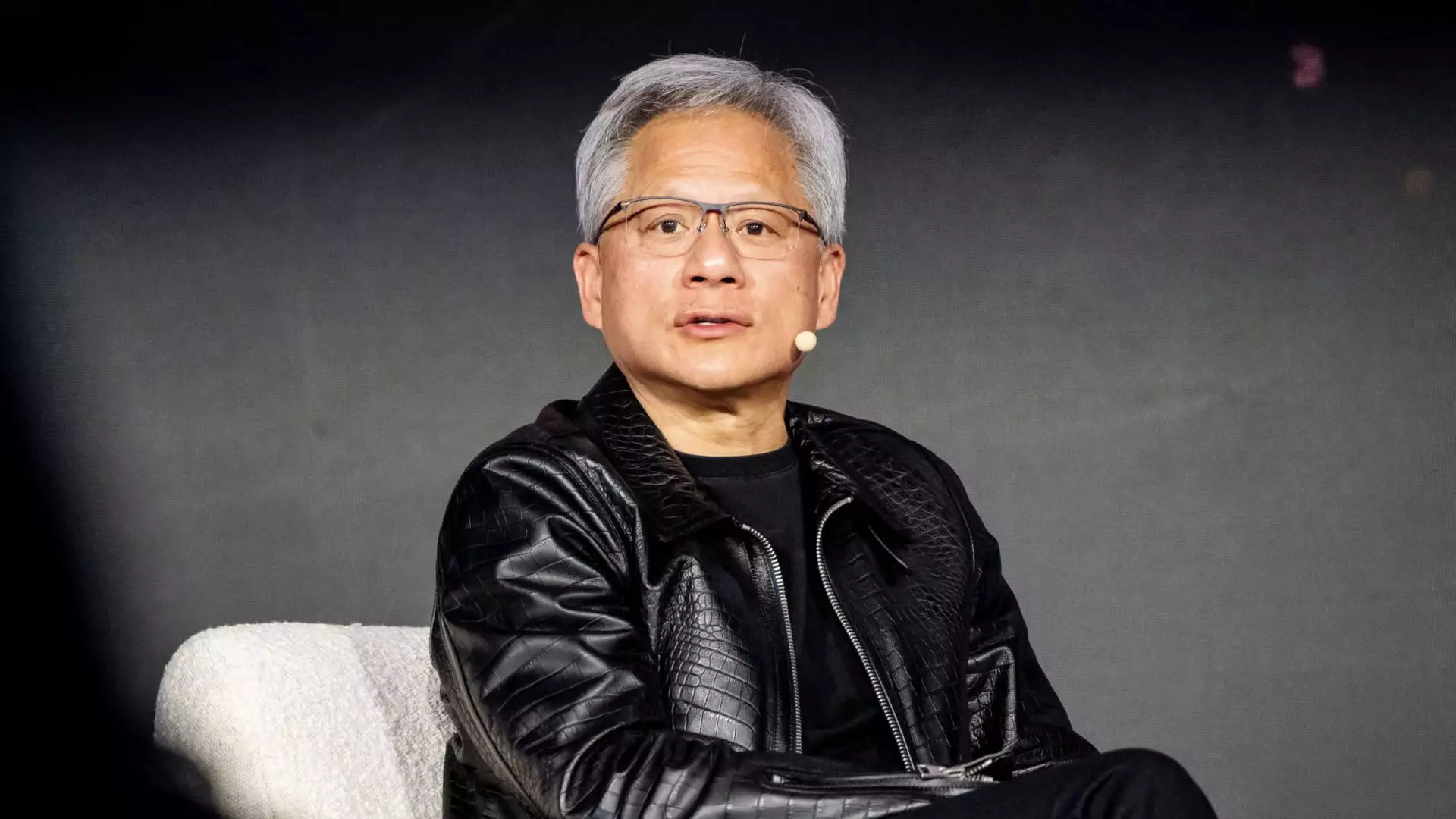

As Nvidia navigates through the current turbulence, it will be crucial for the company to maintain open lines of communication with investors and stakeholders. CEO Jensen Huang has expressed confidence in the demand for Nvidia’s powerful chips, which are essential for next-generation AI models requiring significant computational resources. Recognizing that the computing demands have escalated drastically—where “the amount of computation necessary to do that reasoning process is 100 times more than what we used to do”—hints at the potential for sustained growth.

While the recent slide in Nvidia’s stock value presents a challenge, it is imperative to recognize the underlying strengths of the company and its prominent role in a critical growth sector. The tech giant will need to adapt to market uncertainties and leverage its technological advancements to regain stability and investor confidence.

Leave a Reply