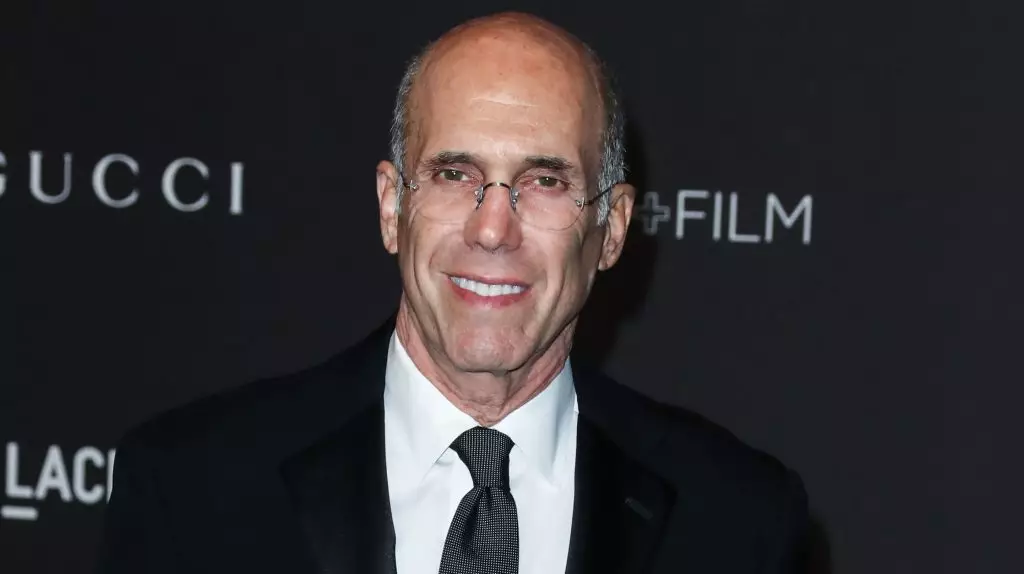

Jeffrey Katzenberg, a prominent figure in Hollywood, expresses his belief that a Paramount-Skydance deal would be highly beneficial for both Paramount and the industry as a whole. He highlights the complexity of the situation, noting the failed David Ellison deal and the challenges that arise from it. Katzenberg acknowledges Ellison’s entrepreneurial spirit and passion for the movie business, indicating that his involvement would have been advantageous. Despite the setbacks, Katzenberg remains optimistic about the potential success of the deal and urges not to overlook Ellison’s involvement in future negotiations.

While Paramount is still in talks with David Ellison, the exclusive negotiating window has ended. Additionally, the studio is engaging with a rival bidding team comprising of Sony and Apollo. The Sony-Apollo offer presents more financial benefit for shareholders but is accompanied by regulatory risks. Katzenberg points out the challenges associated with the FCC’s approval of a private equity firm taking control of broadcast assets. This poses a significant obstacle in the path towards a successful deal, considering the stringent regulatory environment.

Another potential scenario that could unfold is Paramount’s controlling shareholder, Shari Redstone, choosing to delay any deal and revisit the situation in the future. This approach involves Ellison and his backers acquiring Redstone’s stake in the company with minimal benefits for common shareholders. The company would remain intact and continue to operate as a public entity. This alternative has garnered support from within Hollywood circles, presenting a nuanced perspective on the deal’s potential outcomes.

The shareholders seem optimistic about the prospective $26 billion offer from Sony and Apollo, inclusive of Paramount’s existing debt. A special committee within Paramount’s board has taken the initiative to engage with both bidding teams, indicating a level of interest and consideration for the proposed deals. The financial aspect of the offer seems to appeal to shareholders, signaling a positive reception towards the potential acquisition.

The landscape surrounding the Paramount-Skydance deal is intricate and multifaceted, with various parties involved and divergent perspectives at play. Despite the challenges and regulatory hurdles, there remains a sense of anticipation and cautious optimism within the industry. The decisions made by key stakeholders, such as Jeffrey Katzenberg and Shari Redstone, will ultimately shape the trajectory of the deal. As negotiations continue and potential scenarios unfold, it is essential to critically analyze each aspect and consider the long-term implications for Paramount, Skydance, and the broader entertainment landscape.

Leave a Reply