The complex relationship surrounding foreign investments in the United States remains at the forefront of national discourse, particularly in the case of the $14.9 billion bid by Nippon Steel for U.S. Steel. The Biden administration’s recent decision to delay a mandatory abandonment of the deal until June 2025 illustrates the intricate balance of interests at play—national security, labor concerns, and international relations.

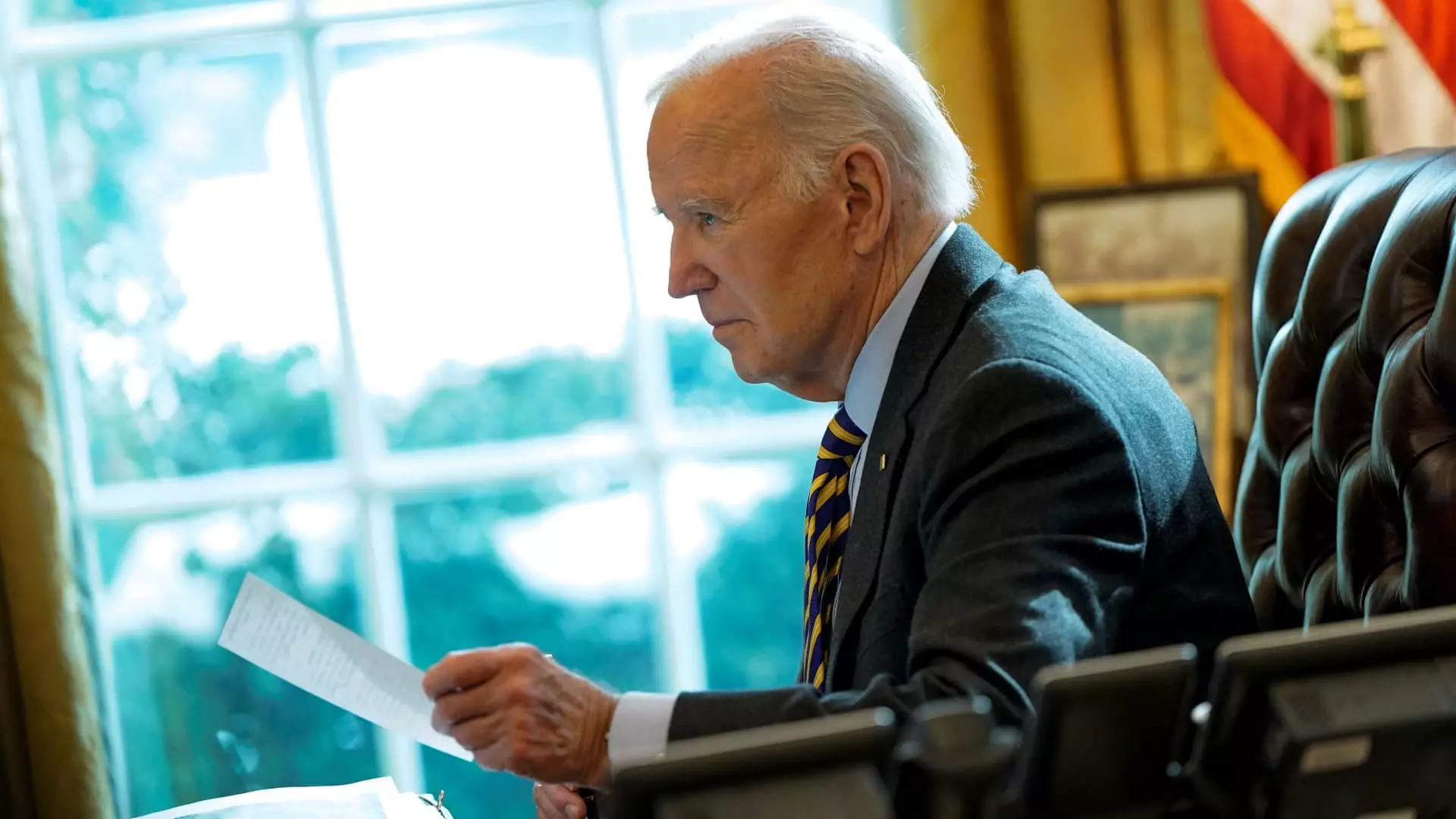

On January 3, President Biden utilized national security as the rationale for placing a hold on the Nippon Steel-U.S. Steel acquisition. This decision sparked immediate controversy, given its vast implications for foreign investment. The Treasury’s Committee on Foreign Investment in the United States (CFIUS), which plays a critical role in evaluating such mergers, conducted a comprehensive assessment of the deal. The Secretary of the Treasury, Janet Yellen, emphasized that the proposal underwent a rigorous review, highlighting the administration’s commitment to ensuring that foreign acquisitions do not compromise domestic security. The ongoing scrutiny reflects the Biden administration’s cautious approach to foreign equity in key industries, particularly those deemed essential to national infrastructure.

The steel giants involved have now found themselves enmeshed in a legal battle, seeking redress against Biden’s order. Their objections center on claims of an unfair review process—asserting that the CFIUS did not give a balanced consideration due to the president’s pre-existing bias against the merger. The companies are pushing for a fresh review, aiming to overturn the decision and revive what they argue is critical for the prosperity of the American steel industry. Their stance underscores a broader corporate strategy that often prioritizes expansion through strategic acquisitions, which can lead to enhanced capabilities and efficiencies.

In conjunction, the iron and steel sectors of the U.S. economy are vital not just for job creation, but for maintaining competitive standing globally. Nippon Steel and U.S. Steel assert that the merger would secure a robust future for the industry, undoubtedly a persuasive narrative for stakeholders wary of the rapid evolution of global steel markets.

Adding another layer of complexity to this situation is the political backdrop against which these negotiations unfold. Both President Biden and former President Donald Trump had previously expressed reservations regarding Nippon Steel’s interest in U.S. Steel. This bipartisan skepticism reflects a critical electoral calculus: courting union votes, which are pivotal in both major parties’ strategies, especially within the industrial heartlands of the United States. As union fears gain traction, labor dynamics are a crucial factor, influencing not just local economies, but decision-making at the executive level.

Moreover, responses from international players add to the intricacies. Japanese Foreign Minister Takeshi Iwaya has publicly conveyed disappointment over the U.S. decision, stressing its potential negative impact on U.S.-Japan relations. He highlighted Japan’s position as a significant investor, indicating that decisions perceived as exclusionary could foster anxieties within the wider business community, possibly jeopardizing future investments.

The journey ahead for Nippon Steel and U.S. Steel epitomizes the delicate balancing act that characterizes foreign investments in the U.S. economy. As the June 2025 deadline approaches, various stakeholders—from corporate entities to labor unions and international partners—will continue to weigh in on the pressing issues involved. Although the geopolitical landscape is fraught with uncertainty, the need for mutual understanding and cooperation remains paramount.

As the CFIUS conducts further scrutiny and the judicial system navigates the legal challenges presented by the steel manufacturers, the implications of this case will likely reverberate throughout the broader economic landscape. Ultimately, the situation underscores the increasingly cautious nature of U.S. foreign investment policies and the imperative for constructive dialogue among all parties involved. No outcome is predetermined, but one thing is clear: the intricacies of such mergers continue to be at the crossroads of national security, economic strategy, and international diplomacy.

Leave a Reply