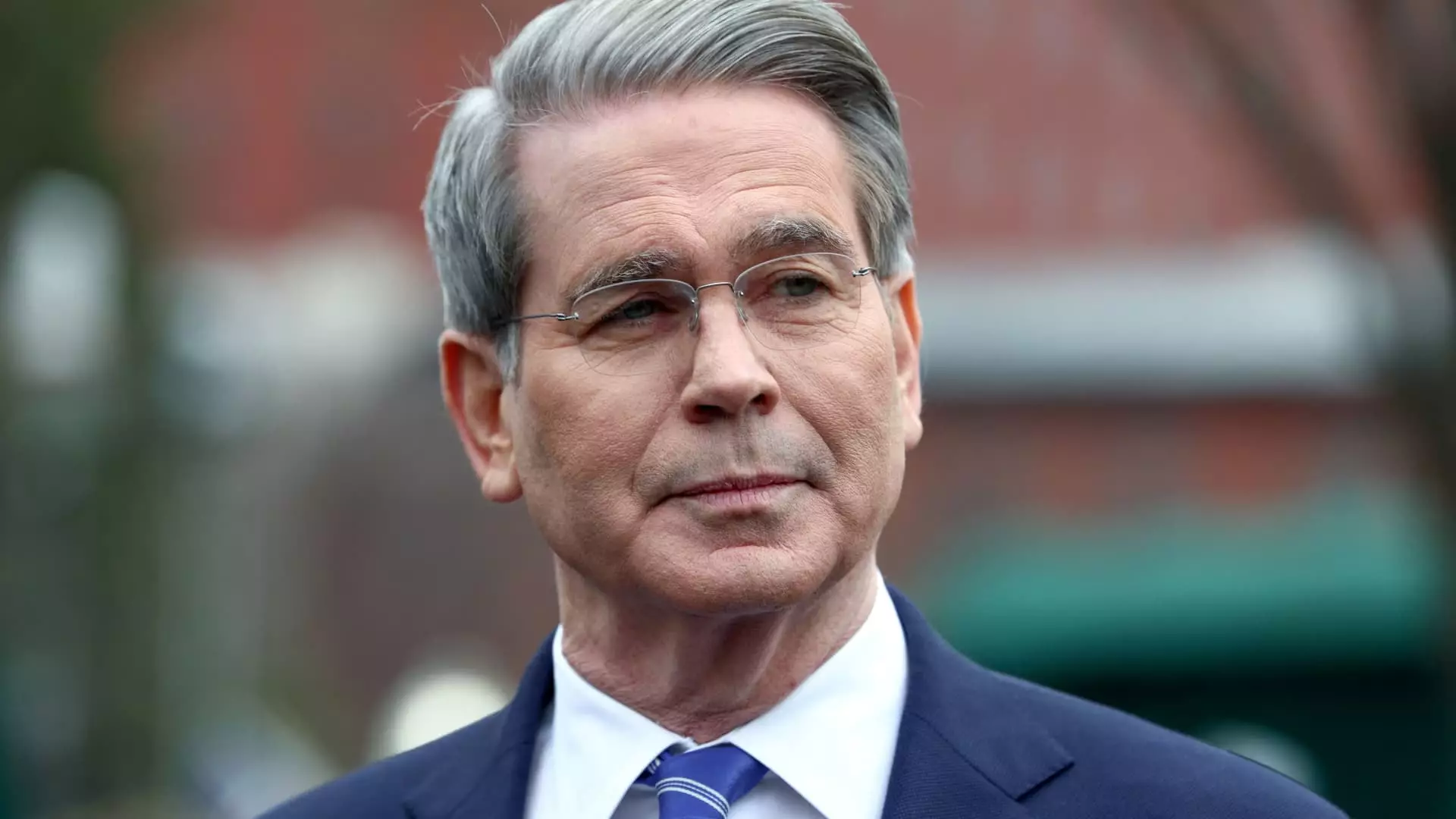

In the realm of American politics, few figures have stirred the economic pot quite like former President Donald Trump. His administration’s rhetoric has often been a powerful blend of bravado and optimism, promising a long-lasting economic revolution. However, as Treasury Secretary Scott Bessent recently posited during an interview, this narrative can come across as dangerously misleading. Bessent dismissed concerns regarding an imminent recession and arguments surrounding Americans’ retirement plans, framing such fears as a “false narrative.” The crux of the issue lies in whether we should genuinely believe that this optimistic outlook aligns with the ground reality.

When Bessent suggests that Americans are unfazed by short-term market fluctuations, one must ask whether this is a genuine reflection of Americans’ sentiments or wishful thinking. Many prospective retirees have experienced firsthand the volatility of their retirement investments, particularly following recent stock market drops fueled by controversial policy decisions, such as aggressive tariff announcements. Despite the official narrative, evidence suggests that for many, retirement planning is intricately linked to the performance of the stock market. Assertions that Americans merely adopt a long-term view ignore the psychological strain of seeing years of savings decimated by sudden market shifts.

The Tariff Tango: An Economic Gamble

The repercussions of Trump’s tariffs, touted as a bold move aimed at rectifying trade imbalances, are particularly noteworthy. The stock market did not react kindly to these announcements, culminating in historically significant losses. In the wake of this turbulence, investors were urged to “hang tough” by Trump himself. However, relying on vague promises of a so-called economic revolution after alluding to these dramatic losses raises serious questions about the administration’s grasp on economic realities.

Bessent’s defense of Trump’s policies suggests he is attempting to draw parallels with Ronald Reagan’s approach to inflation. But such historical comparisons can be misleading; the economic landscape of today is markedly different from that of the 1980s. The notion that we can endure economic choppiness for the promise of stability and growth perpetuates an illusion that many in the electorate desperately want to believe but find increasingly tenuous. Holding the course, as Bessent claims, may instead lead to long-term damage to consumer confidence and financial stability.

Undercurrents of Discontent: The Reality of Unsustainable Systems

Moreover, Bessent’s remarks about the “unsustainable system” built over decades deflects accountability away from the current administration’s very own policies. While it is indeed valid to critique past administrations for fostering situations leading to deficits and trade imbalances, the question remains: Are current measures genuinely rectifying these long-standing problems, or are they merely compounding them?

Bessent’s commentary insinuates that our trading partners are “taking advantage” of the U.S., yet economic interdependence complicates this narrative. It is naïve to suggest that imposing tariffs will rectify these imbalances without provoking retaliatory measures, leading to trade wars that can further destabilize the economy. In essence, Trump’s administration risks adopting a combative stance rather than engaging in meaningful diplomacy, which would allow for more sustainable economic relationships and risk mitigation.

Public Sentiment: The Vulnerability of the Average American

Perhaps the most alarming part of this saga is the way it trivializes the financial security of ordinary Americans. Retirement savings, which many have painstakingly built over decades, should not be dismissed with a wave of the hand. The average American does not have the luxury of insulating themselves against short-term market volatility. To suggest that those nearing retirement should simply disregard the loss of their hard-earned money undermines the real pain faced by individuals who are counting on these savings for their livelihood.

In the end, it is crucial for policymakers and economists alike to engage with these realities—not through the lens of idealistic narratives but through a frank acknowledgment of the challenges ahead. The weight of economic policy should not be merely theoretical; it demands a grounded understanding of the hopes, fears, and aspirations of the people who are affected most by these decisions.

Leave a Reply