Amidst rising tensions between the United States and China, the U.S. government recently issued draft rules aimed at restricting or requiring notification of certain investments in artificial intelligence and other technology sectors in China that could potentially threaten U.S. national security. These rules were proposed in response to an executive order signed by President Joe Biden in August of last year, reflecting a broader effort to prevent U.S. knowledge and resources from aiding China’s technological advancements and global dominance.

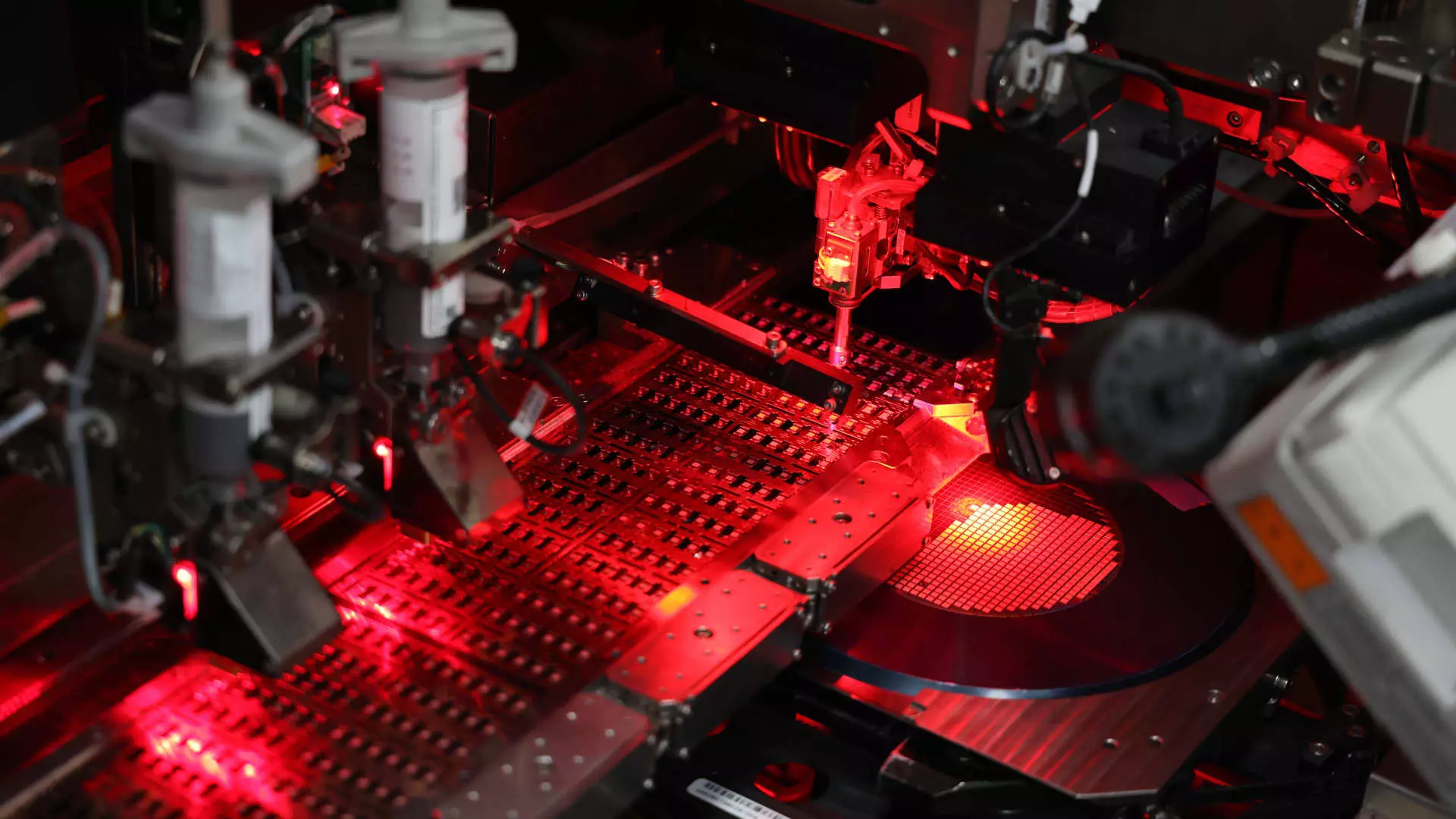

The U.S. Treasury Department released the draft rules, putting the responsibility on U.S. individuals and companies to identify which transactions would be subject to restrictions or outright bans. These regulations primarily target investments in semiconductors, microelectronics, quantum computing, and artificial intelligence. While the primary focus is on China, the order also includes Macao and Hong Kong, with the potential for expansion to other regions in the future.

Former Treasury official Laura Black emphasized the need for increased due diligence by U.S. investors looking to engage with Chinese companies or invest in the specified sectors. The proposed rules have raised concerns for U.S.-managed private equity and venture capital funds, as well as investments by U.S. limited partners in foreign managed funds. The regulations also have implications for investments in third countries, potentially restricting certain transactions that could have indirect ties to China.

Companies found in violation of these regulations could face criminal and civil penalties, including the unwinding of investments. The goal of these restrictions is to prevent U.S. funds from inadvertently contributing to the development of China’s technological capabilities, especially in areas critical to its military modernization. U.S. allies and partners have also been engaged in discussions regarding the objectives of these investment restrictions.

The proposed rules are currently open for public comments until August 4th, allowing stakeholders to provide feedback on the potential impact of these regulations. Treasury Assistant Secretary for Investment Security, Paul Rosen, highlighted the importance of these rules in safeguarding U.S. national security interests and preventing sensitive technologies from falling into the wrong hands.

As the U.S. government moves forward with implementing these regulations by the end of the year, it is crucial for U.S. investors and companies to carefully evaluate their investments and transactions involving China and other specified sectors. The evolving landscape of U.S.-China relations underscores the necessity for heightened vigilance and compliance with these restrictions to mitigate any potential risks to national security.

Leave a Reply