In a game-changing development for political forecasting, Polymarket, a leading online election betting platform, is set to re-establish its operations in the United States. This decision comes on the back of its noteworthy accuracy in predicting the election outcome of President-elect Donald Trump. At the forefront of this resurgence is Polymarket’s founder and CEO, Shayne Coplan, who acknowledged the effort involved in legalizing political prediction markets in America during his recent appearance on CNBC’s “Squawk Box.” His comments underscore a pivotal moment in the industry, reflecting a newfound optimism regarding the expansion of prediction markets in the U.S.

Currently, Polymarket’s services are restricted to international markets due to previous legal hurdles, including a $1.4 million penalty imposed by the Commodity Futures Trading Commission (CFTC) in 2022 for operating without proper registration. However, recent court rulings have opened the door for renewed operations. Coplan’s insights suggest that a significant shift is on the horizon, marking Polymarket’s ambitions to compete vigorously in a revitalized marketplace.

The recent U.S. Appeals Court ruling that lifted a freeze on election contracts for Kalshi by the CFTC is a critical milestone for the broader prediction market landscape. This ruling graced Kalshi with the opportunity to launch its election contracts, presenting a much-needed precedent for competitors like Polymarket. The court’s acknowledgment that a showing of irreparable harm was a requisite for a stay reflects a maturing legal environment around prediction markets, allowing for operational freedom and bolstered investor confidence in these platforms.

Market players such as Interactive Brokers and Robinhood are also entering the fray, bringing their own election-related products to market. Founders of these companies, including Thomas Peterffy, project that the significance of these prediction markets could rival that of traditional equity markets in the coming years. Their assertion reinforces the idea that political prediction is no longer merely speculative; it has transformed into a substantial financial market with real stakes.

One compelling argument favoring prediction markets is their inherent financial motivation tied to user engagement. Unlike traditional polling methods, where results are based purely on survey feedback, prediction markets harness the power of monetary stakes. Robinhood CEO Vlad Tenev articulated this advantage, asserting that those with money on the line tend to invest more thought and consideration into their predictions.

As such, prediction markets like Polymarket have the potential to provide insights that could, arguably, be more reliable than traditional polling. This assertion was echoed by notable figures, including Elon Musk, who praised Polymarket for its accuracy, emphasizing that its predictions are more reflective of real-time public sentiment due to the financial commitment of its users.

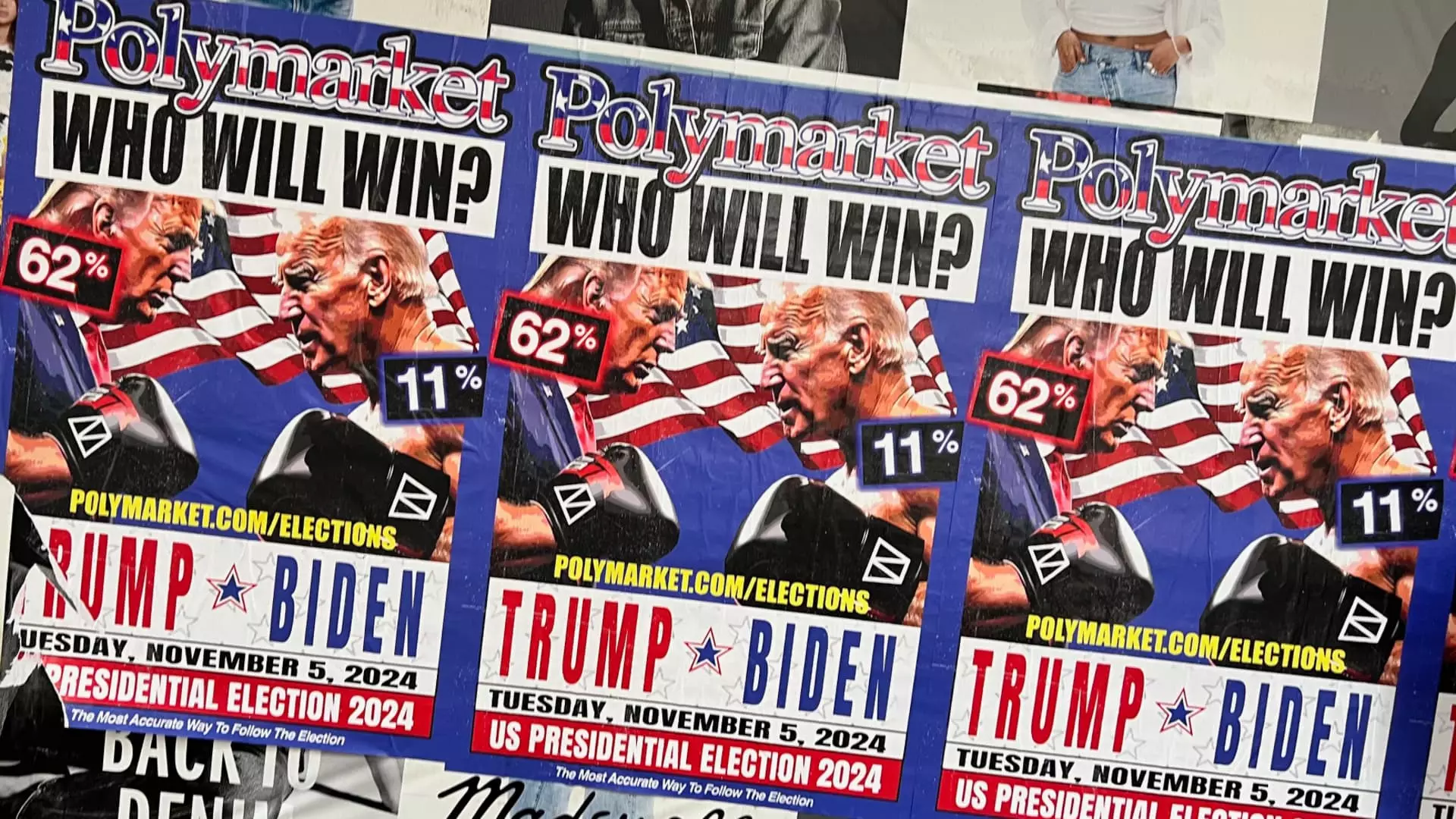

The upcoming 2024 presidential race has already become a focal point of speculation on various prediction markets. The earlier success of Polymarket, evidenced by the nearly $3.7 billion trading volume on its platform during the last election, illustrates a compelling case for the financial market’s role in shaping electoral outcomes. As Coplan noted, while traditional media suggested a tight race, prediction markets reflected a different reality—one where Trump’s victory appeared almost certain.

This disparity showcases the Overton window’s evolution, a term Coplan referenced to describe a shift in public policy acceptance. As prediction markets continue to evolve and capture broader attention, they may influence how the public perceives impending electoral events.

The resurgence of Polymarket, alongside its competitors, signals a new phase for political prediction markets in the U.S. With favorable legal developments and a track record of accuracy, the stage is set for these platforms to make significant inroads into the political betting landscape. As more Americans pay attention to these markets, the interplay between electoral predictions, public sentiment, and financial stakes will likely become an ever-important narrative leading up to the 2024 elections and beyond, encapsulating a significant transformation in how elections are forecasted and understood.

Leave a Reply