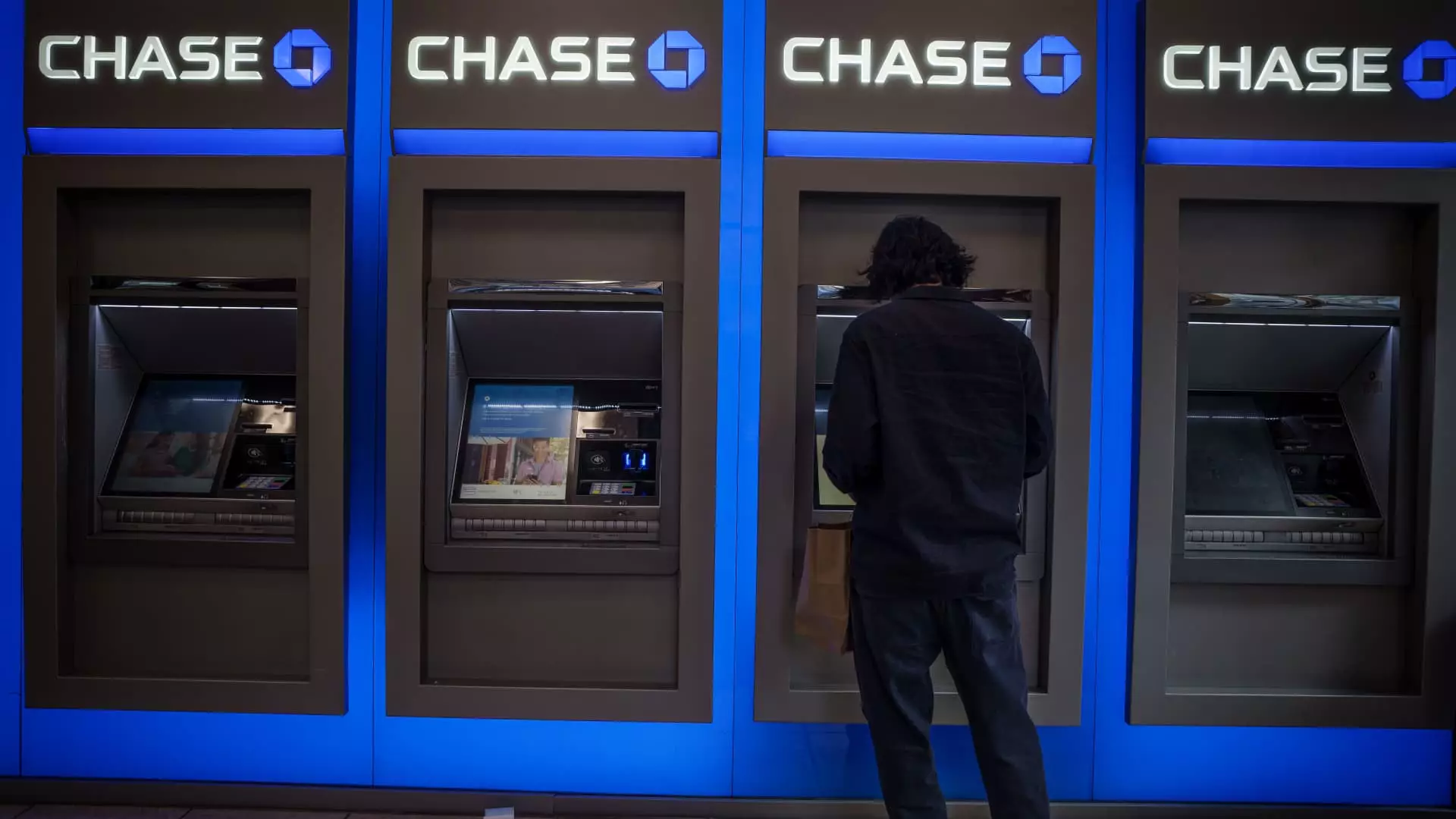

In a surprising turn of events, JPMorgan Chase has initiated legal action against a number of customers implicated in exploiting a significant loophole known as the “infinite money glitch.” This phenomenon became widely recognized in late August, particularly on platforms like TikTok, where users showcased their ability to withdraw substantial sums of money from ATMs before the checks they deposited bounced. The bank has pursued lawsuits in several federal courts, highlighting its commitment to combat growing fraudulent activities. One specific case from Houston stands out; it involves a defendant who allegedly owes the bank an astonishing $290,939.47 following the deposit of a counterfeit check amounting to $335,000.

The origin of the glitch appears to stem from a momentary oversight in JPMorgan’s check processing system that allowed individuals to access funds prematurely. According to legal filings, the sequence began when a masked individual deposited a significant check into a Chase account and nearly immediately initiated withdrawals. This perplexing scenario raises critical questions about the vulnerabilities inherent in banking systems, particularly in an era when technology is meant to bolster security.

The incident illuminates a growing concern related to the intersection of technology, social media, and traditional banking methods. Despite a clear evolution toward digital transactions over physical checks, the latter still plays a significant role in banking fraud—evidenced by the staggering global losses of $26.6 billion reported in the past year alone. The incident around the “infinite money glitch” serves as a stark reminder of how social media platforms can both engage and mislead impressionable users. Viral videos depicting easy cash withdrawals propagate the idea that illicit behavior can yield financial benefits, tempting individuals to take questionable actions.

JPMorgan Chase was quick to act, addressing this vulnerability by noting that they closed the loophole within days of its discovery. However, the question remains whether such rapid closure was adequate given the scale of the exploitation. Additionally, it brings forth broader inquiries about the responsibility of financial institutions to safeguard their clients against not just internal errors but also external influences that can spur unethical behavior.

On the legal front, JPMorgan has submitted multiple lawsuits targeting varying dollar amounts, with sums ranging from approximately $80,000 to $141,000. These actions represent a significant pivot for the bank, marking a zero-tolerance approach toward fraud. Each legal complaint aims to recover funds, plus interest, overdraft fees, and legal costs. More importantly, they signal that the bank intends to deter similar actions in the future by orchestrating a strong response to perceived fraud.

However, it’s worth noting that the majority of cases currently under investigation are for smaller amounts, indicating a widespread issue that may involve numerous lower-level offenders—those often overlooked in narratives dominated by high-dollar fraud cases. This highlights the complexity of addressing banking fraud, where vast numbers of potential cases can strain resources and law enforcement capabilities.

Drew Pusateri, a spokesperson for JPMorgan, articulated the banks’ position succinctly: “Fraud is a crime that impacts everyone and undermines trust in the banking system.” This sentiment encapsulates the profound ripple effect that instances of fraud can have, not just on the institution itself but also on public confidence in financial systems. As JPMorgan continues its pursuit of justice, it is imperative for the bank and the industry at large to reinforce their commitments to security, transparency, and ethical practices.

The legal actions taken by JPMorgan Chase against individuals exploiting the “infinite money glitch” are not merely isolated incidents; they represent a pivotal moment in the continuous struggle against financial fraud in an increasingly digital world. As technology evolves, so too must the measures taken to safeguard against threats, ensuring that trust remains at the very foundation of our banking institutions.

Leave a Reply