The global semiconductor industry experienced a notable uptick in stock values following the impressive fourth-quarter results posted by Foxconn, formally known as Hon Hai Precision Industry. The company recently announced a staggering revenue of 2.1 trillion New Taiwan dollars, which translates to approximately $63.9 billion. This figure reflects a remarkable 15% increase year-over-year and signifies Foxconn’s strongest fourth-quarter financial performance in its history. As a major supplier for tech giant Apple, Foxconn’s robust earnings suggest a vibrant growth trajectory for semiconductor companies, buoyed primarily by the increasing demand for artificial intelligence (AI) technologies.

Foxconn’s latest results underscore a distinct trend in the semiconductor market, particularly the rising revenues from cloud and networking products. The firm attributed this growth to the heightened demand for AI servers from chipmakers like Nvidia, which are essential for nurturing advanced AI applications. While the productivity of computing products and consumer electronics—including popular items like iPhones—showed modest declines, the overall positive outlook for the AI market lights the path for sustained industry growth. This bifurcation in product performance, where traditional consumer electronics slightly lag while AI-related products surge, paints a comprehensive picture of the semiconductor landscape.

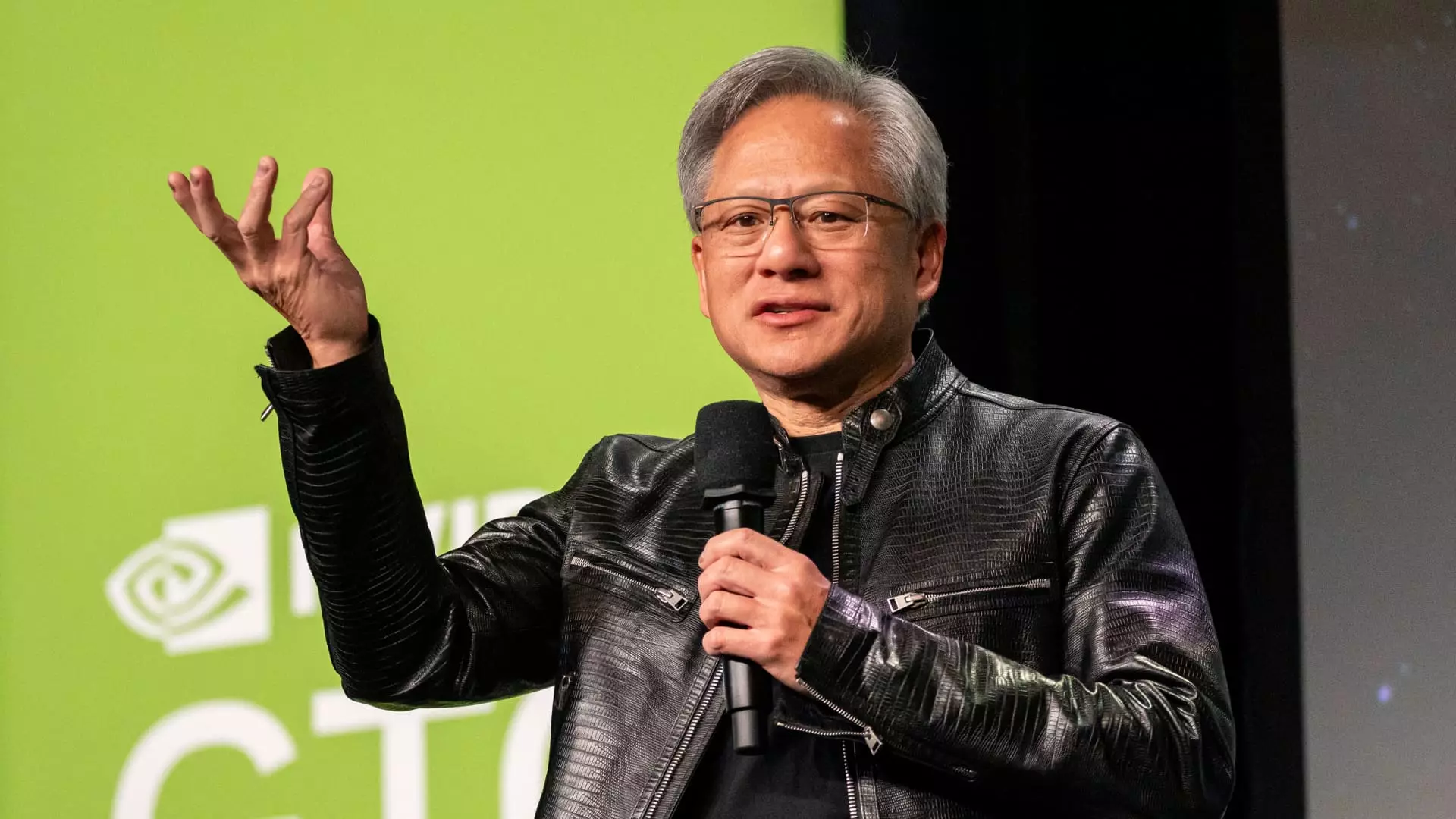

Following Foxconn’s announcement, semiconductor stocks surged across various regions, reflecting investor optimism about the potential of AI. In the United States, shares of Nvidia enjoyed a boost, rising over 3%, amidst anticipation surrounding CEO Jensen Huang’s keynote at the upcoming Consumer Electronics Show. The ripple effects were felt by other chip manufacturers as well; for instance, AMD also reported gains of more than 3%, while Qualcomm and Broadcom saw their shares climb over 1%.

This upward trend wasn’t confined to North America; Asian markets saw significant activity with Taiwan Semiconductor Manufacturing Company (TSMC) hitting new highs. TSMC, a critical supplier for various prominent firms, demonstrated resilience and the capacity to meet growing demand, closing nearly 5% up. Other notable advances included substantial increases for South Korean giants SK Hynix and Samsung, who experienced remarkable share price surges of nearly 10% and 4%, respectively.

European semiconductor stocks echoed the upbeat sentiment, with major equipment manufacturers seeing similar gains. ASML, a leader in critical semiconductor equipment, saw its shares rise by 8.7%, while ASMI reported a 6.2% increase in stock value. Germany’s Infineon joined the ranks of manufacturers benefiting from the A.I. buzz with nearly a 7% rise, while the Paris-listed STMicroelectronics experienced a near 7.9% upswing. These increases underline the broader significance of semiconductor manufacturing, not just in fabricating chips but also in equipping companies to capitalize on the ever-expanding AI market.

One key driver of this semiconductor renaissance is the strategic investments being made by industry leaders. Microsoft’s recent announcement of an $80 billion investment plan for establishing data centers capable of managing AI workloads further highlights the increasing reliance on advanced processing capabilities. As companies continue to explore the depths of AI technology, the corresponding demand for powerful GPUs from firms like Nvidia only solidifies the market’s growth trajectory.

The strategic maneuvers being made by these tech titans underscore an industry pivot that could redefine market dynamics in the coming years. With players like Microsoft leading the push for innovations tailored to computational efficiency, the synergy between software capabilities and semiconductor output is becoming increasingly palpable.

The recent surge in semiconductor stocks, spurred largely by Foxconn’s record revenues and the escalating demand for AI-focused technologies, paints a promising picture for the sector. The diverse strategies employed by semiconductor firms across the globe illustrate a collective awareness of the shifting market demands and a willingness to adapt. As AI continues to permeate various aspects of daily life, the semiconductor industry stands poised to capitalize on this momentum, hinting at an exciting future that lies ahead. The strong performance of key players not only signals growth but also establishes a foundation for long-term resilience in an ever-evolving technological landscape.

Leave a Reply