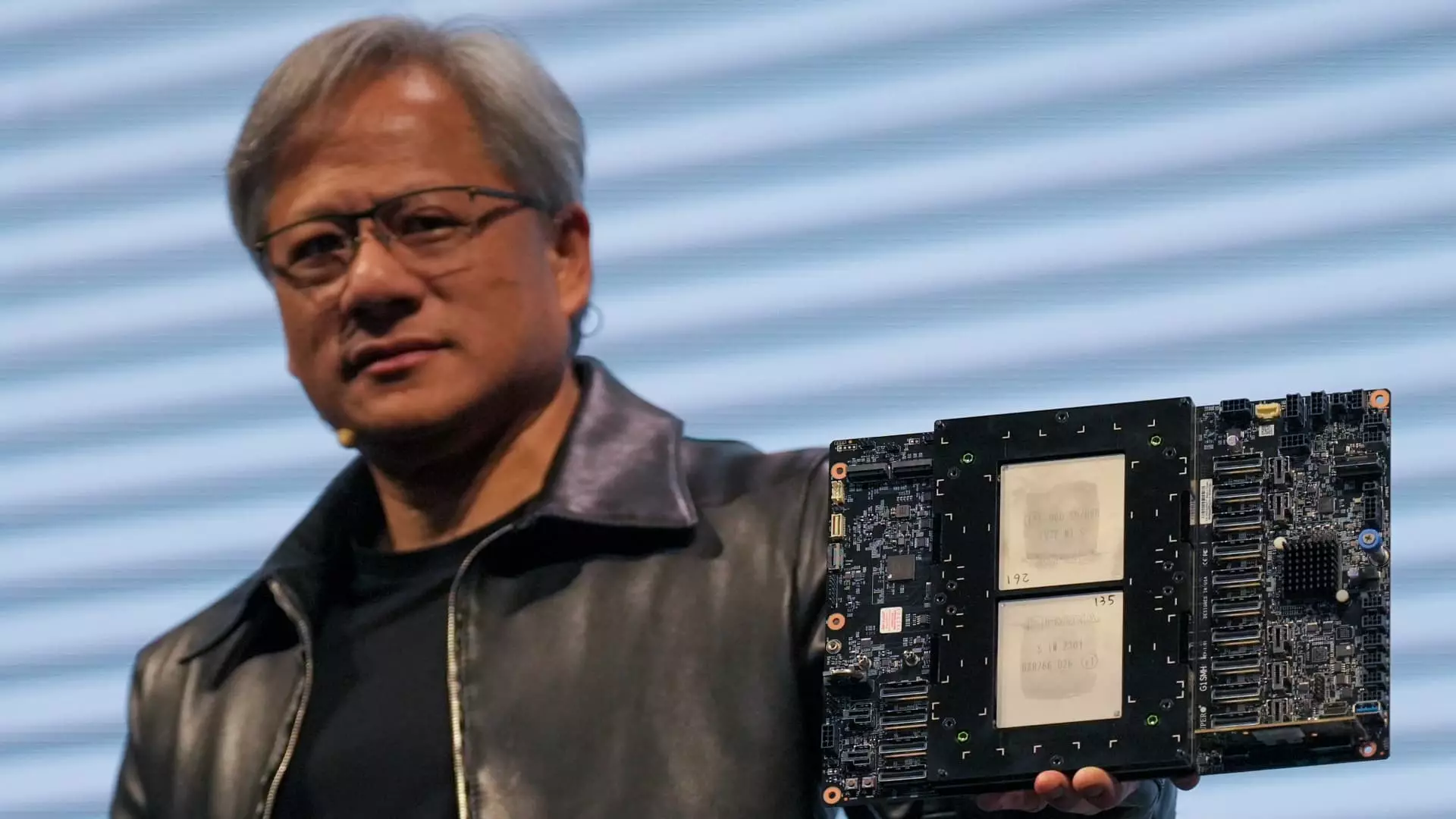

Nvidia, a renowned chipmaker, experienced a significant milestone as its shares surged past $1,000 for the first time in extended trading following the release of its fiscal first-quarter results. This highlights the increasing investor interest in the company’s performance, particularly in relation to the ongoing AI boom. The company reported earnings that exceeded analyst expectations, showcasing the robust demand for the AI chips it produces. CEO Jensen Huang revealed that revenue from the new generation AI chip, Blackwell, is expected later this year, further indicating positive growth prospects. Notably, the stock price jumped by 7% in extended trading, emphasizing the market’s confidence in Nvidia’s future trajectory.

Nvidia’s quarterly report revealed compelling financial metrics, with adjusted Earnings Per Share (EPS) of $6.12 compared to analyst estimates of $5.59, and revenue of $26.04 billion surpassing the expected $24.65 billion. The company’s outlook for the current quarter also exceeded Wall Street expectations, with projected sales of $28 billion. Net income for the quarter reached $14.88 billion, a significant increase from the previous year, underlining the substantial growth Nvidia has experienced. This surge in financial performance can be attributed to the escalating demand for advanced processing units by tech giants like Google, Microsoft, and Amazon, who use Nvidia’s products for AI applications.

Nvidia’s data center business has emerged as a key driver of its revenue growth, with sales in this category soaring 427% to $22.6 billion in the last quarter. The company’s AI chips, coupled with the necessary components for large-scale AI servers, have contributed significantly to this revenue surge. Nvidia’s finance chief, Colette Kress, highlighted the substantial shipments of Hopper graphics processors, including the H100 GPU, to major cloud providers like Meta. This underscores the pivotal role that Nvidia plays in supporting the infrastructure for AI-related activities, particularly in data centers.

Apart from its data center segment, Nvidia continues to witness strong performance in other areas of its business. The gaming division, traditionally known for its hardware for 3D gaming, experienced an 18% revenue increase to $2.65 billion in the last quarter. This growth was fueled by robust demand for gaming products, showcasing Nvidia’s ability to cater to diverse market segments. Additionally, the company’s networking parts and professional visualization sales exhibited substantial growth, reflecting the increasing importance of connectivity solutions in the era of AI-driven technologies.

Nvidia’s proactive approach to strategic investments and financial decisions has further solidified its position in the market. The company repurchased $7.7 billion worth of shares and paid $98 million in dividends in the last quarter, demonstrating its commitment to delivering value to shareholders. Furthermore, Nvidia’s decision to increase its quarterly cash dividend from 4 cents to 10 cents per share, on a pre-split basis, underscores its confidence in sustainable growth and rewarding investors. This proactive stance towards capital allocation reflects Nvidia’s long-term vision and financial strength in navigating the competitive tech landscape.

Nvidia’s remarkable performance in the AI market, fueled by its innovative products and strategic investments, positions the company as a key player in the industry. The surge in share price, robust financial metrics, thriving data center sales, and diverse revenue streams underscore Nvidia’s ability to capitalize on the increasing demand for AI technologies. With a solid foundation in both traditional and emerging markets, Nvidia is well-positioned to sustain its growth trajectory and drive further innovation in the dynamic tech landscape.

Leave a Reply