The recent pull of investors towards technology stocks marks a significant shift in the financial landscape, spurred by the Federal Reserve’s decision to lower its benchmark interest rate for the first time since 2020. This strategic move by the central bank not only aims to stimulate economic growth but also resonates within the tech sector, which has seen a marked increase in investor confidence as a result.

On a notable day for the markets, the tech-heavy Nasdaq composite soared by 2.5%, showcasing one of its most considerable rallies of the year. Key players in the tech industry, such as Tesla and Nvidia, led this significant turnaround, with shares of Tesla surging by 7.4% and Nvidia climbing by 4%. This sharp rise in stock value reflects the broader trend of investors gravitating towards technology amidst lower borrowing costs and the subsequent reduction in bond yields, which make equity investments appear relatively more enticing.

The embrace of tech stocks by investors was accentuated by the Federal Open Market Committee’s projections, which hinted at the potential for further cuts in interest rates. These future reductions, expected to amount to an additional 50 basis points, could provide continued support for the rising tech sector. Such fiscal measures would arguably bolster companies leveraging innovative technologies, especially as the Nasdaq approaches its peak from mid-July of this year.

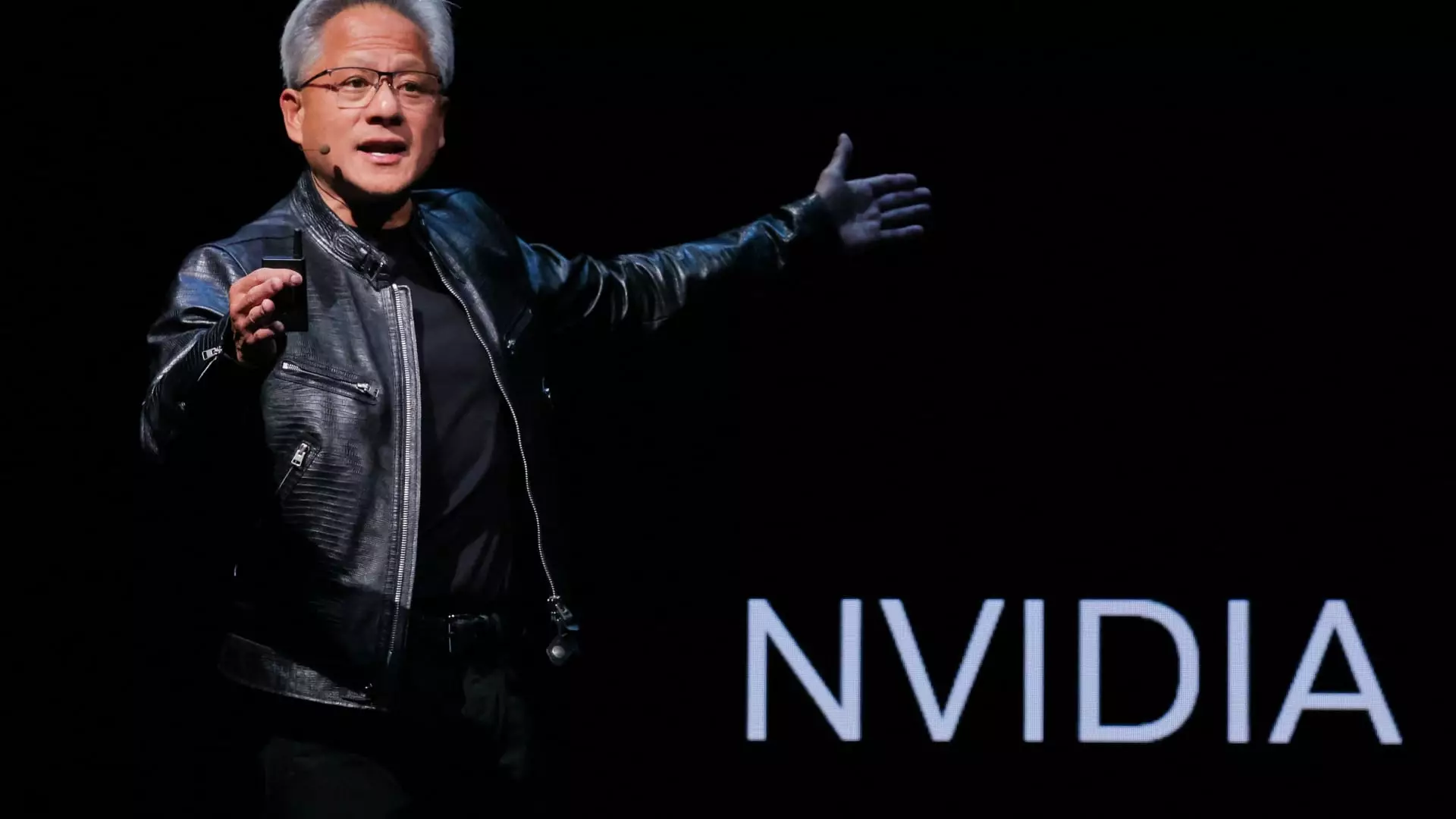

Central to the rally is the growing allure of artificial intelligence (AI), with Nvidia standing as a prominent benefactor of this trend. Nvidia’s processors have become instrumental in the expansion of generative AI applications, fueling products like OpenAI’s ChatGPT. Despite a remarkable year-to-date increase of approximately 138%—a figure buoyed by a staggering tripling of its value in 2023—Nvidia’s stock still lingers at 13% below its historic peak. This situation highlights the company’s reliance on a narrow customer base comprising major tech giants like Microsoft, Meta, and Amazon.

While the enthusiasm surrounding AI propels Nvidia’s stock, it also introduces a level of vulnerability. Market watchers remain alert to any signs of diminished demand among these key clients, which could adversely impact Nvidia’s performance. In a similar vein, other semiconductor players, such as Advanced Micro Devices (AMD) and Broadcom, also experienced notable gains in reaction to the Fed’s announcement. However, AMD’s aspirations to compete in the AI realm remain tempered as it faces skepticism from investors, evident in its modest 6% increase this year.

The Federal Reserve’s rate cuts have broader implications that extend beyond immediate stock market reactions. As borrowing costs decline, businesses, particularly in the tech sector, find themselves in favorable conditions for expansion and innovation. Companies are more inclined to invest in cutting-edge technologies and long-term projects, which could usher in transformative changes across various industries—including education and healthcare, as forecasted by industry leaders like AMD’s CEO Lisa Su.

Tesla’s impressive performance—paradoxically amidst a challenging year—serves as another testimony to the tech sector’s resilience. Even though the company had trailed the broader Nasdaq index through much of the year, its 72% recovery from April’s low highlights the volatility and potential for rapid gains in the tech stock market. Moreover, other luminaries in the sector, such as Apple and Meta, also made notable strides, each boasting a nearly 4% increase in their share prices.

Despite the current optimism, the tech sector is not entirely devoid of uncertainties. Rising interest rates in the future could thwart the upward trajectory of these stocks, making it imperative for investors to tread cautiously. Moreover, the reliance on AI-driven developments sparks debates over sustainability and ethical considerations. As tech trends often unfold over extended periods, the maturity of innovations in AI and their integration into daily life remain uncertain yet hopeful.

Ultimately, while recent moves by the Federal Reserve create a short-term boon for tech stocks, the long-term implications of these investments, market dynamics, and competitive landscapes will forge the future of the technology sector. Investors are undoubtedly watching closely, aware that in the fast-paced world of tech, change is the only constant.

Leave a Reply